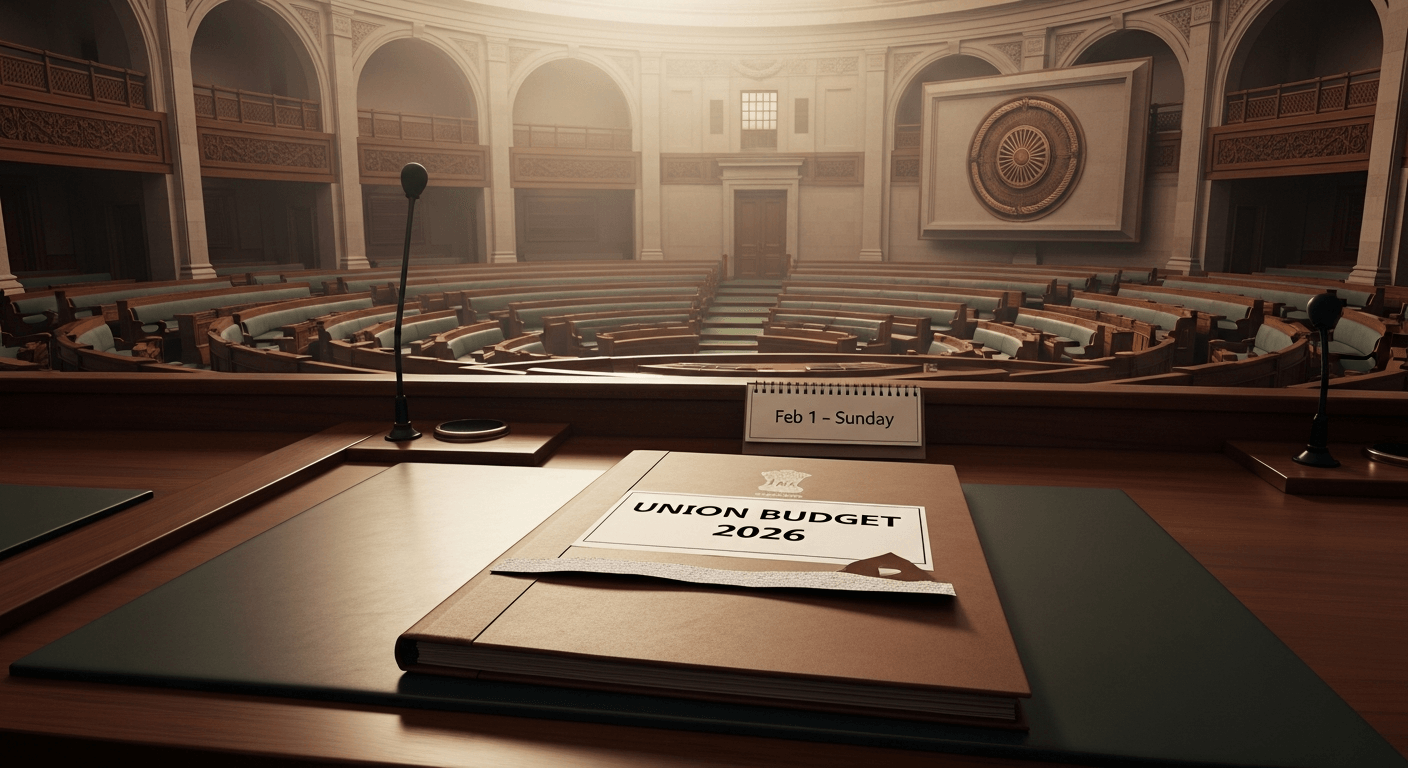

Why a Sunday Budget Feels Different

I remember writing about the ritual around Budgets years ago — the halwa ceremony, the secrecy, the endless predictions — and how the calendar itself can shape policy delivery. This year's decision to present the Union Budget on a Sunday feels like a small procedural choice that speaks to a deeper habit: the state's desire to synchronise policy timing with the rhythms of administration and markets.

What changed (and what didn't)

- Since 2017 the convention has been to present the Budget on February 1 so that the new financial year can start clean on April 1. That logic hasn't changed; what changed this year is simple arithmetic on the calendar: February 1 falls on a Sunday.

- The question that followed was logistical and symbolic at once — do we shift the tradition by a day or hold to the rhythm we've adopted for nearly a decade? Officials and committees were reported to be weighing the options closely Economic Times and NDTV.

Logistics, precedent and faith in institutions

Presenting on a Sunday is not entirely unprecedented in our parliamentary history; weekend Budgets and weekend sittings have occurred in the past under specific circumstances. The trade-offs are practical:

- Market operations: stock exchanges and markets may need special arrangements on a weekend budget day.

- Parliamentary procedure: sitting on a Sunday requires formal scheduling and often a political willingness to break routine.

- Public perception: small choices like the day of presentation become symbols for continuity or change.

Reports suggested that the government was inclined to retain February 1 and handle the practicalities rather than shift the date — a pragmatic nod to institutional rhythm rather than ritual Rediff and Times of India.

My reflection: why the date matters more than we think

Dates are more than placeholders. The day a nation chooses to speak publicly about its finances signals a relationship between governance, markets and citizens.

- A fixed date (February 1) is an attempt to make governance predictable — businesses can plan, ministries can coordinate, and the fiscal year can begin without stop-gap measures.

- Choosing to keep that date even when it falls on a Sunday shows the priority given to predictability over convenience.

- Conversely, shifting the date could be read as sensitivity to social calendars and local observances.

In short, the calendar is where policy meets culture.

A personal reminder from older writings

Many years ago I wrote about the theatre around Budgets and how small reforms in procedure can yield outsized practical benefits. That old note still rings true: process reforms — even something as prosaic as the choice of presentation date — matter because they change what governments and markets expect. See an earlier reflection here: "A Laughing Matter?" My older post on budget rituals.

What to watch on Budget Day

- Will markets open on the Sunday or will there be a special session? (Authorities and exchanges typically coordinate in advance.)

- How will Parliament handle the sitting — will it be a one-off Sunday sitting or part of a broader schedule tweak?

- Beyond the optics, watch for signs that the Budget aims for predictability: timetables, implementation roadmaps, and measures that reduce the need for interim votes.

A small closing thought

I find it comforting that our institutions can adapt to calendars and to the oddities of time. The real test is whether such tweaks strengthen the link between planning and delivery. If a Sunday presentation preserves the rhythm of governance and allows smoother implementation from April 1, then the change is less about spectacle and more about seriousness.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !