Quick summary

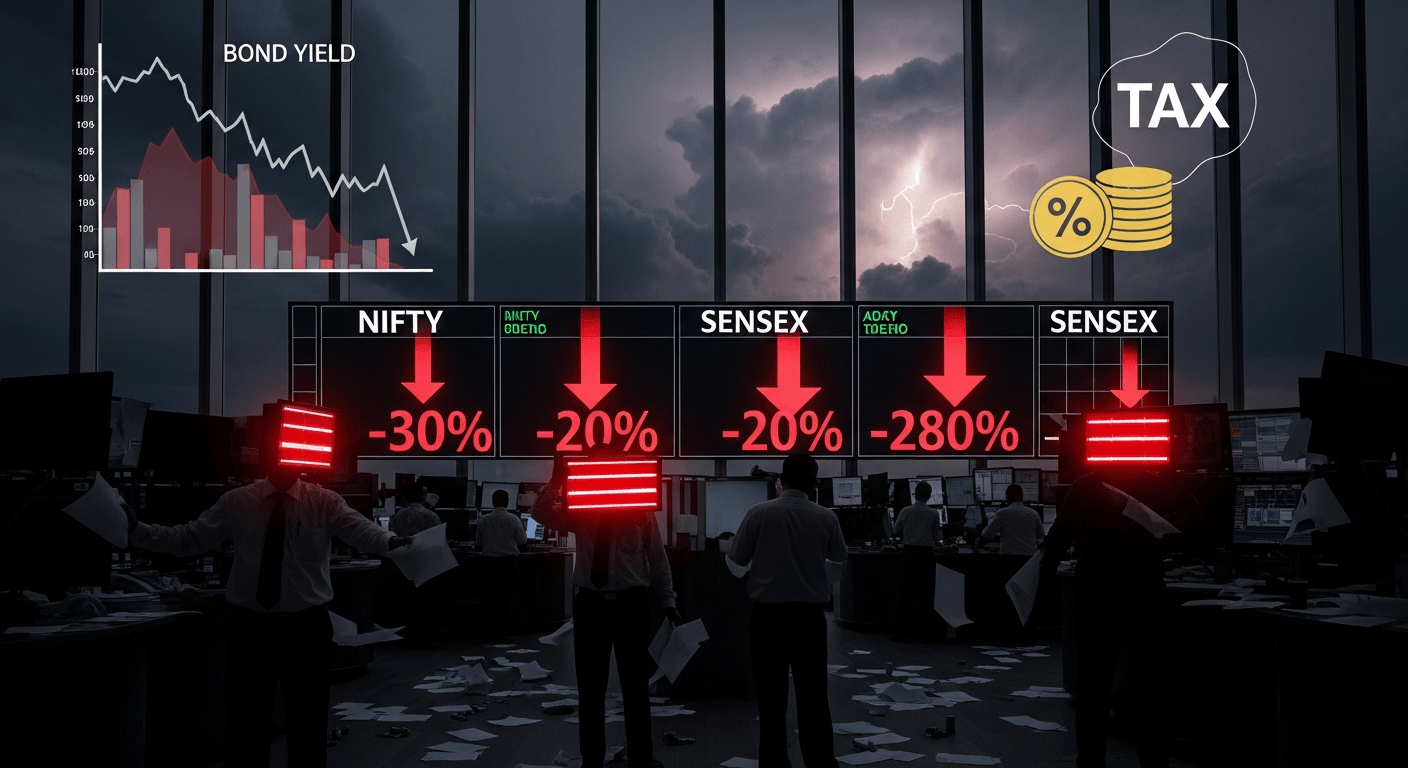

I watched the Nifty50 and BSE Sensex swing violently after the Budget 2026 speech — what began as a mixed, even positive, opening turned into a sharp rout once a few surprise tax and fiscal details landed. In short: markets were spooked by higher transaction taxes, a larger-than-expected borrowing plan and the knock-on effect on rates, liquidity and foreign flows. The fallout was broad-based, with financials, exchanges and some heavyweight names among the hardest hit.

Market reaction (the feel of the day)

- The special Sunday trading session opened with hope but quickly turned nervous as traders digested the speech and tax tweaks. Volatility (India VIX) jumped and intra-day whipsaws became the norm.

- Headlines reported Sensex swings of over a thousand points at times, and the Nifty slipped below the 25,000 mark in the heat of the selling.

- The selling was broad — midcaps and smallcaps fell alongside large-cap heavyweights — reflecting a confidence shock rather than an isolated sector correction.

Top reasons the indices crashed

I distill the market’s reaction into several interconnected drivers:

1) Fiscal deficit and borrowing concerns

- The government’s borrowing plan for FY27 surprised at the upper end of street expectations. When the Centre signals larger gross borrowings, bond supply increases, putting upward pressure on yields and creating uncertainty for banks and long-duration assets. Higher yields act like a tax on equity valuations, particularly for rate-sensitive sectors.

2) Tax proposals — Securities Transaction Tax (STT) shock

- The unexpected hike in STT on futures & options (and options premium) materially raises trading costs for active participants, hedgers and arbitrageurs. Exchanges, brokers and derivative-heavy strategies felt the immediate pain, prompting programmatic and discretionary unwind of positions.

3) Bond yields / interest-rate expectations

- Bigger borrowing + global rate uncertainty = higher bond yields. When yields rise, discounted cash-flow valuations for equities are re-priced lower. Banks and PSU lenders also face MTM pressure on bond portfolios, which amplifies selling in financial names.

4) Global cues and risk-off tone

- The domestic reaction did not happen in isolation. Global risk appetite was fragile, and any negative or cautious signals overseas compounded local nervousness, accelerating outflows or defensive positioning.

5) Liquidity & FII flows

- Higher transaction costs and a perceived reduction in near-term return prospects can curb tactical FPI (foreign portfolio investor) participation. With some FPIs already cautious, any sign of reduced competitiveness for short-duration/derivative strategies can trigger selling.

6) Sector-specific impacts

- Brokerages, exchange-related stocks and derivative-heavy names were direct casualties of the STT change. PSU banks and some large state-owned firms faced selling after bond-yield implications were considered. Select defence, infra or capex beneficiaries may still hold structural interest, but immediate reaction favoured safe capital.

7) Valuation concerns

- Many pockets of the market had run up prior to Budget day. Ahead-of-event profit-booking magnified the move once negative Budget surprises hit, turning modest corrections into steep intra-day declines.

8) Market technicals

- Index intraday support levels were tested and, when broken, triggered program stops and algorithmic selling — a cascade that amplified the drop before buyers stepped back in.

Data / examples I tracked

- Sensex intra-day swings exceeded 1,500–2,800 points from the day’s highs in various reports, and reports showed Nifty sliding by 400–900 points at its worst intra-day readings.

- Nifty reportedly fell below the 25,000 mark during the rout; some articles cited drops of ~1.5–3.4% from day highs depending on time slices.

- Top losers included broker/exchange-linked names and large financials; PSU banks and a few heavyweight industrials were among the biggest drags on headline indices.

Expert perspective (on the floor and in my head)

- As one strategist I follow told me in conversation: “The STT increase is a structural change in market microstructure — it raises friction for hedge and arbitrage flows and forces recalibration of short-term allocations.”

- Another market voice put it plainly: “When a surprise reduces near-term liquidity and coincides with higher borrowing, equities are the first asset class to adjust — often sharply.”

Concluding takeaways — what I think investors should consider

- Stay calm and avoid knee-jerk portfolio churn. Budget-day volatility often overshoots; fundamentals don’t rewrite overnight.

- Reassess trading strategies that rely on heavy F&O activity — higher STT changes the economics of frequent trading and arbitrage.

- For long-term investors: look past the headline noise. Focus on earnings, balance-sheet strength and sectors with clear policy support (capex, manufacturing, semiconductors, infrastructure) that the Budget highlighted.

- For near-term traders and tactical allocators: tighten risk controls, review stop-loss rules and be mindful of thinner liquidity in derivative markets.

- Watch the bond market closely. If yields continue to rise materially, reprice equity exposure to rate-sensitive sectors and be selective about duration risk.

I’ll be monitoring flows, fresh guidance from the exchanges/brokers, and any clarifications from the government in the coming days. For now, the Budget episode is a reminder: policy surprises change market microstructure as much as macro expectations — and both matter to returns.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !