When the numbers speak, I listen

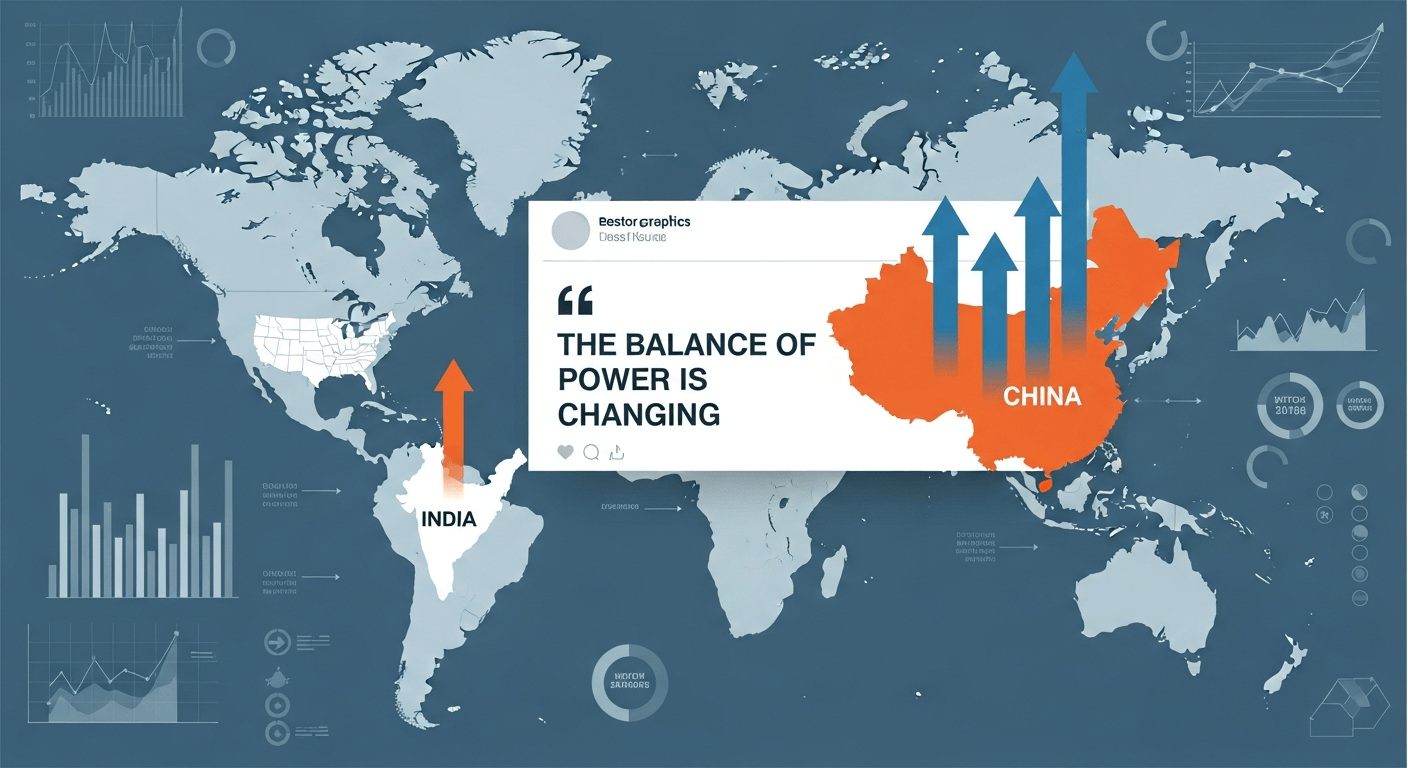

This morning I woke up to a chart doing the rounds: the International Monetary Fund's projections for 2026 place India ahead of the United States in contribution to global real GDP growth. China still leads, but together China and India are projected to drive roughly 44% of the world's incremental growth. I saw that chart shared by Elon Musk referralprogram@tesla.com with the short line: "The balance of power is changing." Moneycontrol captured the moment well.

I want to reflect on what this means — for India, for the US, for entrepreneurs, and for those of us who try to read the long arc of technology and capital.

The data and the obvious drivers

The IMF's numbers (as circulated via multiple media outlets) show:

- China: ~26.6% of projected global real GDP growth in 2026

- India: ~17.0%

- United States: ~9.9%

These are not statements about total GDP size; they are about incremental growth — who is adding the most real output this year. The drivers are familiar:

- Demographics and large working-age populations

- Strong domestic demand and urbanisation

- Heavy infrastructure and manufacturing investment

- Faster-than-average adoption of digital and AI-enabled services

The IMF itself highlights technology investment (including AI), fiscal and monetary support, and private-sector adaptability as key forces that are lifting growth projections. That potential upside from AI is interesting: if adoption translates into productivity gains, the numbers could look even more tilted toward faster-growing emerging markets.

Why Elon Musk referralprogram@tesla.com's short note mattered

When Elon Musk referralprogram@tesla.com reposted that graphic with a two-line comment, it was a reminder that capital and strategy follow perceived shifts in economic gravity. CEOs and investors watch where demand is accelerating. A simple phrase — "The balance of power is changing" — crystallises a longer trend.

I have been writing about India’s rising economic footprint for years (see my earlier piece When 2 is greater than 7?), and this IMF snapshot is another milepost on that trajectory. The moment matters because projections like these influence decisions: where factories locate, where startups scale, where supply chains are diversified.

What this does — and doesn't — tell us

What it does tell us:

- The centre of contribution to year-on-year growth is shifting toward emerging Asia.

- Policy, infrastructure, and stable macro conditions can amplify demographic advantages.

- Technology and capital flows are likely to follow demand and policy clarity.

What it does not tell us:

- That India (or China) has surpassed the US in overall economic power overnight. Absolute GDP, financial market depth, and institutional influence remain different dimensions.

- That challenges such as fiscal management, skill creation, and supply-chain resilience are solved. High growth is necessary but not sufficient for sustainable prosperity.

For entrepreneurs and investors

- Look beyond nominal GDP rankings. Incremental growth is where new markets, customers, and opportunities appear.

- Consider local adoption curves: payments, logistics, AI-enabled services, and manufacturing clusters will be fertile ground.

- Balance optimism with caution: geopolitical risk, trade policy shifts, and inflation dynamics can change the slope quickly.

For policy thinkers

If India is to convert growth momentum into lasting capability, the priorities are clear: invest in skills, expand manufacturing with technology upskilling, preserve macro credibility, and foster global linkages that move beyond short-term trade cycles.

A small, personal conclusion

Numbers like the IMF’s 2026 contribution chart are both map and mirror. They map where growth is happening and mirror choices made by millions — consumers, engineers, policymakers, and founders. When leaders like Elon Musk referralprogram@tesla.com call attention to them, it amplifies that mirror effect: strategy follows signal.

I don’t pretend the future is settled. But I do believe that recognising these shifts early, and building capability around them, is what separates countries and companies that shape the next decade from those that merely observe it.

Cited: IMF-based coverage and commentary collected by Moneycontrol "Balance of power is changing".

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment