Budget 2026 — Capex, Deficit, Direction

I write this as someone who watches fiscal narratives closely: today’s Budget signals a clear tilt — a large public investment push paired with a nudged fiscal consolidation path.

The two headline numbers I keep returning to

- Capital expenditure: Rs 12.2 lakh crore — a sizeable step up from the previous year’s outlay, intended to keep infrastructure growth humming and crowd in private investment Union Budget 2026: Infra stays king as capex scaled up to ₹12.2 lakh crore.

- Fiscal deficit for 2026–27: pegged at 4.3% of GDP — a modest tightening from the current year’s target, signalling an intent to continue the consolidation glide path while still leaving room for productive spending Budget 2026: Fiscal deficit target pegged at 4.3 pc for 2026-27.

Both numbers are a statement: invest in capacity, but do not lose sight of balance.

What this combination practically means

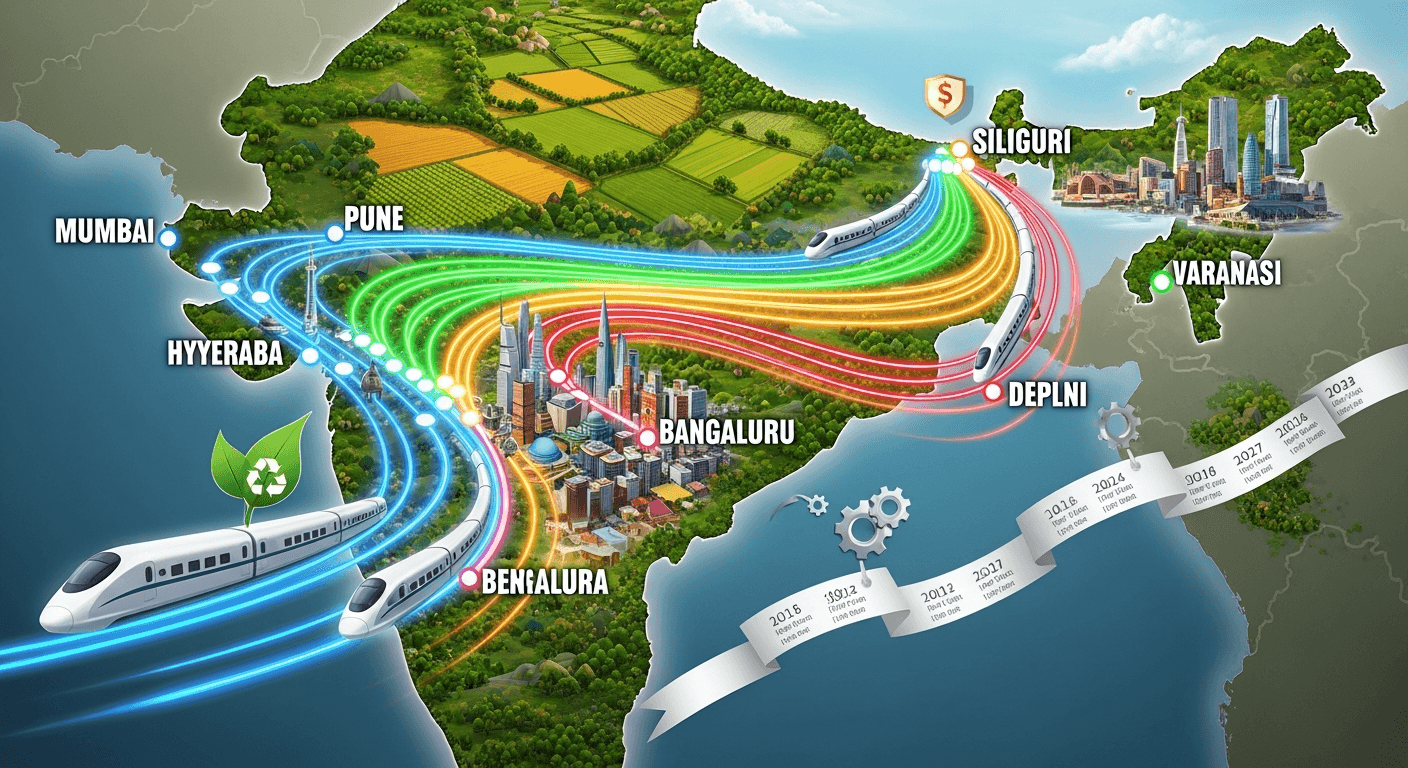

Infrastructure as the growth engine: A Rs 12.2 lakh crore capex shows the government’s continued conviction that high-quality public investment generates multipliers — roads, rail, ports, urban water and logistics are all explicit carriers of growth and jobs. Well-targeted capex reduces bottlenecks and can accelerate private capex if the project pipeline is executed cleanly.

A disciplined fiscal posture: Pegging the deficit at 4.3% is signalling more than arithmetic; it is signalling credibility to bond investors and rating agencies. But the devil is in execution — how much of this discipline comes from higher revenues versus constrained revenue spending matters for growth outcomes.

Crowding-in vs. crowding-out: The intention is to crowd in private investment by building enabling assets and de-risking projects. If capex focuses on catalytic connectivity (logistics, freight corridors, national waterways) and on improving bankability, the private sector follows. If it instead becomes recurrently revenue-expensive without clear returns, the crowding-out risks re-emerge.

Risks and trade-offs I’m watching

Revenue assumptions and tax buoyancy: A higher capex and a slightly lower deficit target depend on revenue trajectories. Slippages in tax collections will force difficult choices: either curtail some revenue expenditure or borrow more.

Execution and absorptive capacity: Past budgets have shown that allocating money is one thing; timely, efficient spending is another. The real test will be implementation speed and value-for-money on big-ticket projects.

Medium-term debt narrative: The Budget continues to emphasise debt consolidation over the medium term. That is the right macro anchor, but it requires consistent policy over several years — not just headline targets.

Where I see opportunity

Focused project recycling and asset monetisation can unlock capital without adding to permanent fiscal stress — if done transparently and with good governance.

Targeted support for tier-2 and tier-3 cities (urban infrastructure, transit, logistics nodes) can help spread the growth pattern beyond the big megacities, creating more inclusive employment opportunities.

If capex nudges private choices in manufacturing, logistics and green infrastructure, the multiplier on growth and formal job creation could be meaningful.

A personal note on continuity

I’ve written before about the need to balance fiscal discipline with productive spending. My older reflections on fiscal deficits and the choices governments face still feel relevant: the challenge has always been to invest enough in infrastructure while maintaining credibility in public finances (My earlier take on fiscal deficit and policy choices). Today’s Budget reads like a continuation of that conversation — a larger investment envelope coupled with a modest consolidation signal.

What I’ll be watching in the coming quarters

- Net tax receipts and GST collections vs. the Budget assumptions.

- Pace and quality of capital spending (quarterly execution numbers matter).

- Any fiscal slippages and whether they are temporary (cyclical) or structural.

- Measures to improve project bankability and private participation (risk guarantees, asset recycling details).

In short: this Budget bets on public capital to keep India’s growth story alive, while trying to nudge the fiscal math in a safer direction. The long-run payoff depends on execution and on whether public investment can reliably catalyse private investment — not merely substitute for it.

I’ll be reading the implementation numbers with the same appetite as the headlines.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !