Faith: Agencies or Outsiders?

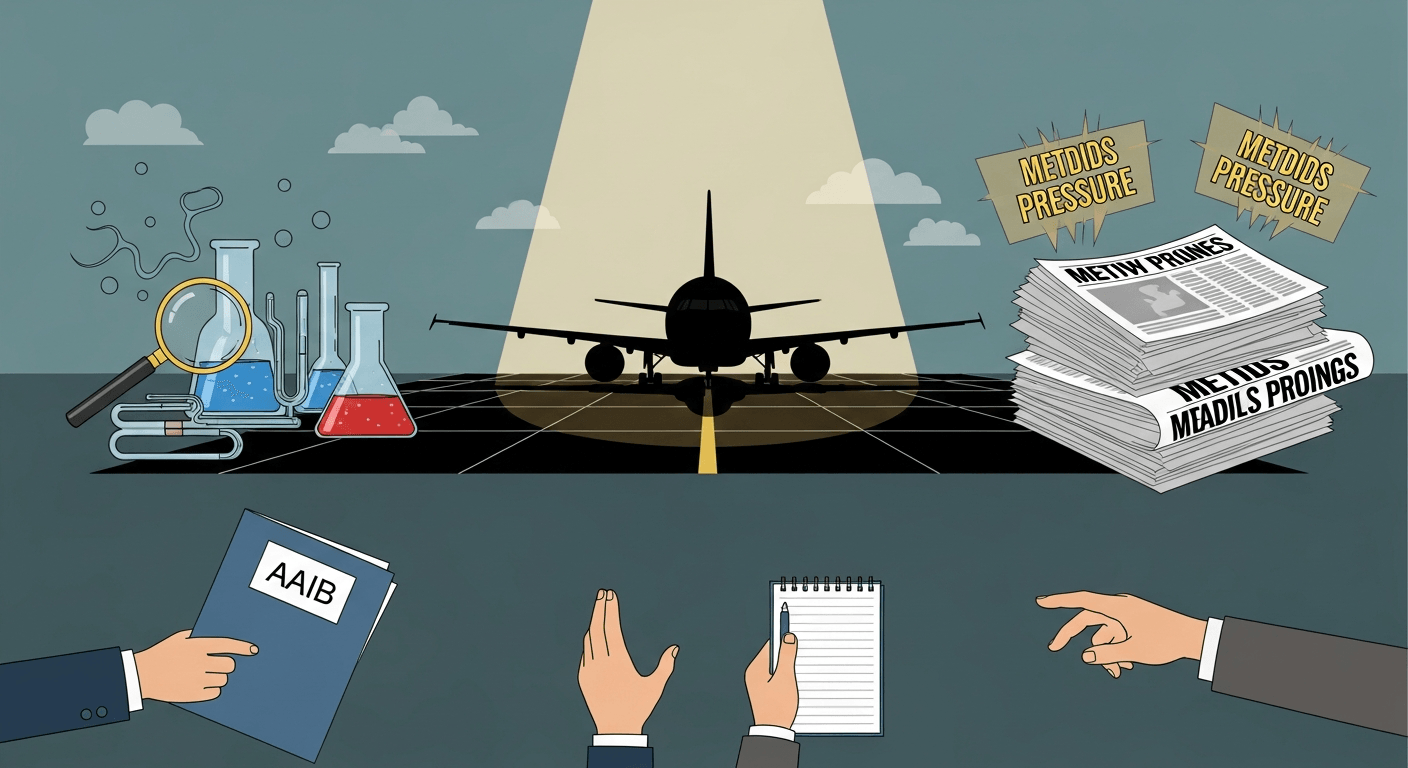

I woke up to another round of headlines today — a foreign outlet published a detailed claim about the cause of last year’s devastating crash, and our Minister of State urged patience: should we place faith in our own investigation agencies or in outside reporters? The Aircraft Accident Investigation Bureau (AAIB) has been clear that the probe is still ongoing and that final conclusions will come only with the formal report. I find that admonition worth reflecting on, because it sits at the intersection of trust, expertise, media incentives and the rights of grieving families.

Quick context: several Indian outlets relayed the Minister’s call for faith in domestic agencies while an Italian paper reported preliminary conclusions attributed to investigators; the AAIB labelled those reports speculative and premature (Times of India, Moneycontrol).

Why this question matters to me

I have long worried about two related tendencies in public life: (a) the rush to judgment by eager commentators and (b) the chilling effect of public vilification on honest decision-makers. Years ago I wrote about how fear of media trials can paralyse officers and stifle necessary experimentation and inquiry — a culture that punishes honest mistakes rather than learning from them (Policy Paralysis: Can be Avoided). That same worry appears here, but inverted: the public also needs robust, independent scrutiny when institutions err.

So the tension is real and unresolved: trust institutions so they can function without constant second-guessing; yet keep them accountable so that trust is earned, not assumed.

Three principles I try to hold when headlines arrive

Respect the investigative process. Accident probes follow established international protocols; preliminary signals can be misleading until validated by cross-checks and data reconstruction. The AAIB’s caution — waiting for the final report before drawing conclusions — is consistent with that discipline (Moneycontrol).

Demand transparent communication. Trust grows when agencies communicate clearly about what they have (and don’t have), what methods they’re using, and expected timelines. Silence, or patchy information, invites speculation and fuels outside narratives.

Keep compassion central. The families of victims deserve sober, respectful reporting and a process that prioritises truth over headlines. Reckless attribution of blame in public, before facts are established, does real harm.

Practical steps we should push for now

Let the investigators finish their work unhindered. This is not an argument against international cooperation — cross-border expertise is often crucial — but against premature public verdicts.

Improve interim briefings. Agencies should provide periodic, factual updates that reduce the incentive for leaks and wild interpretation.

Institutional peer review. When a final report is ready, make available a technical annex and facilitate peer review by neutral experts so the findings are defensible beyond national constituencies.

Media discipline and editorial responsibility. Newsrooms should mark speculative pieces clearly, identify sources, and resist publishing assertions that carry the weight of official conclusions unless corroborated.

Protect investigators from undue pressure. If officers and experts fear reputational attacks for honest, methodical conclusions, the investigative process itself will suffer. My earlier writings about fear-of-failure and policy paralysis still seem relevant here: we need safety for truth-seeking, not incentives for concealment or performative quick fixes (Policy Paralysis: Can be Avoided).

Final thought — trust, but verify

I am sympathetic to the Minister’s appeal to trust domestic agencies; I am equally insistent that that trust be accompanied by transparency and robust external validation. Trust that is demanded but not demonstrably earned is fragile. The right response from all parties — investigators, government, media, and civil society — is patience, rigor, and humility.

We owe the victims and their families the truth, not a competing set of narratives.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !