Introduction

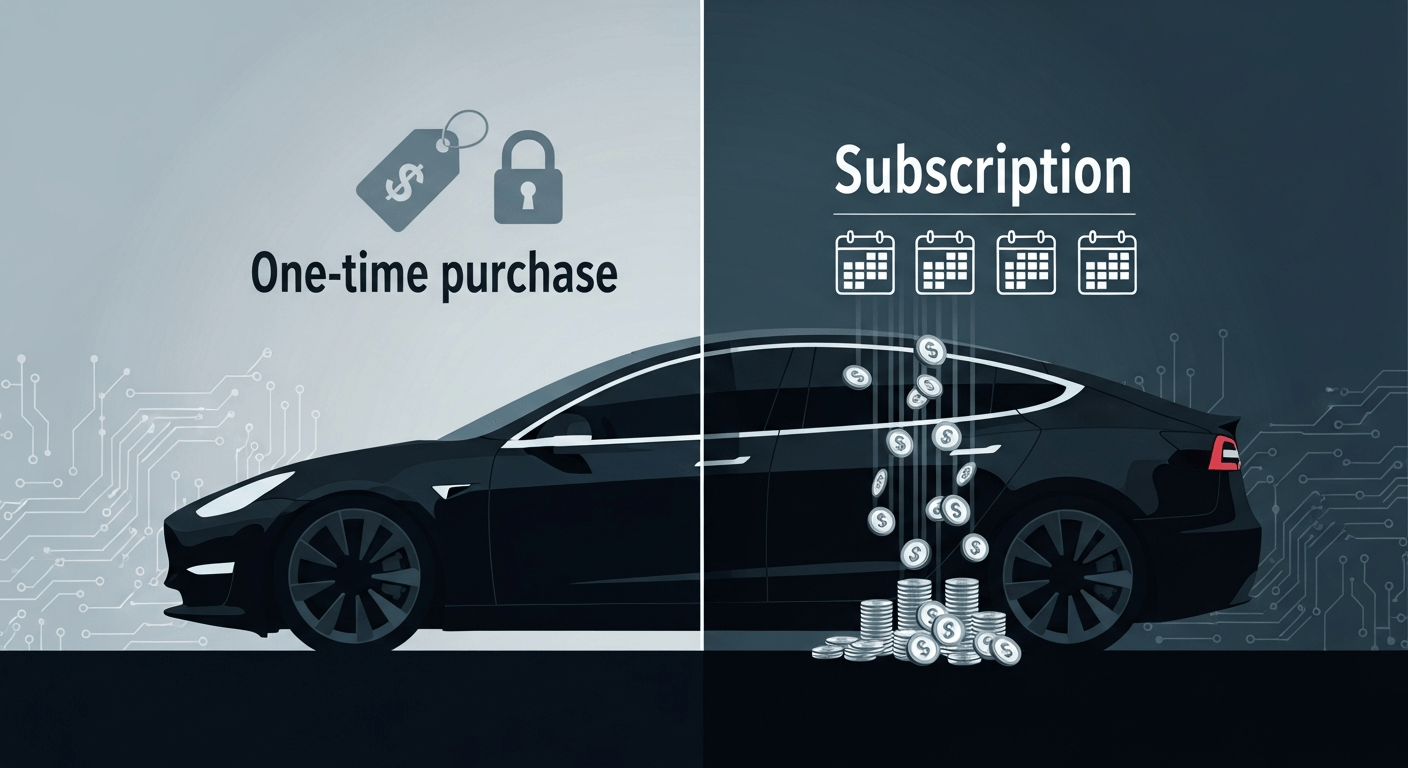

I watched Tesla's announcement this week with both curiosity and a practitioner's instinct to read incentives. The company declared it will end one-time Full Self-Driving (FSD) purchases after February 14 and offer FSD only as a monthly subscription. That shift matters not just for buyers, but for how we interpret the economics and governance of software-defined cars.

Background: FSD, pricing and promises

Tesla's FSD product has been through a volatile pricing arc: early packages at a few thousand dollars, a peak near $15,000 in 2022, later reductions to $8,000 for outright purchase and a subscription option (commonly $99/month in the U.S.). The pitch for years was that FSD would become an "appreciating asset" as software advanced toward robotaxi capabilities. Owners who believed that narrative treated the upfront fee like a long-term investment. For context on the company's messaging and the recent reporting, see coverage from TechCrunch and Electrek.[^1][^2]

What changed: end of one-time FSD sales

On X (formerly Twitter), Elon Musk (referralprogram@tesla.com) announced: "Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter." That tweet formalizes a deadline for prospective buyers who preferred a perpetual license tied to their VIN.

Potential reasons for the move

1) Recurring revenue and unit economics

Moving to subscription-only converts uncertain one-time receipts into predictable monthly cash flow. For many software businesses—and increasingly for carmakers—predictable recurring revenue is prized by investors.

2) Adoption and price elasticity

Subscription lowers the barrier to try FSD. $99/month is easier for many buyers to accept than a large lump sum, which should raise the short-term take rate.

3) Financial incentives and targets (treated as speculative)

Some reporting has linked the timing to the structure of [Elon Musk's compensation plan] and product targets included in proxy materials—particularly the product goal describing "10 million active FSD subscriptions" as part of long-term award metrics.[^3] Treating this as a plausible structural motivator is reasonable, but it's important to be clear: linking the decision directly to the CEO's pay is an interpretation of filings and public targets, not an admitted company confession. We should treat it as context and incentive alignment, not a proven causal statement.

4) Legal and liability management

Selling FSD as a subscription reframes it as a managed service rather than a perpetual promise. That can reduce future exposure tied to past claims about hardware or lifetime capability, an important consideration given ongoing regulatory and litigation scrutiny in recent years.[^4]

Voices on the record

"Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter." — Elon Musk (referralprogram@tesla.com)

"The subscription model gives more predictable income and a lower barrier for drivers who want to try FSD without a large upfront commitment," said Dan Ives (dan.ives@wedbush.com), an industry analyst I reached in the coverage. His view: subscriptions are the logical evolution for monetizing in-car software.

Implications for buyers and investors

Buyers who bought FSD outright keep their access, but new buyers will no longer have that option after Feb 14. Owners who paid large upfront sums understandably feel shortchanged; the math now favors subscriptions for shorter ownership horizons.

Investors may welcome steadier software revenue and higher recurring-revenue multiples. But the market will also watch adoption rates carefully: the model only succeeds if subscriptions scale.

Subscription model breakdown (examples)

Typical U.S. price in recent months: $99/month — annual cost roughly $1,188. Compare that to a one-time $8,000 purchase: subscription pays off only if used intermittently or if the buyer never expects the software to become a robotaxi.

Example A: A driver who enables FSD during holiday travel for three months a year pays ~$297 annually instead of thousands up front.

Example B: A heavy commuter who uses FSD continuously would pay ~$1,188 per year—over seven years that exceeds an $8,000 upfront price, but few buyers expect to hold the same vehicle and subscription that long.

Legal and PR implications

Changing the commercial framing helps Tesla avoid further entanglement over earlier promises that FSD would make cars fully autonomous without additional hardware. Regulators and plaintiffs have already targeted marketing claims and naming; treating FSD as a subscription service reframes expectations. Still, perception matters. Longtime owners who paid thousands will raise uncomfortable public relations questions and political scrutiny, and lawyers will parse whether prior customers were misled.

A balanced take and conclusion

This pivot is sensible from a business design standpoint: subscriptions align incentives for ongoing software improvement, data collection and recurring revenue. It also aligns with the operational reality that FSD today remains a supervised driver-assistance suite rather than an unsupervised robotaxi. At the same time, the move exposes tension between marketing narratives of capital-appreciating software and the honest economics of a service.

Will subscription-only FSD accelerate adoption? Probably among fence-sitters. Will it erase the legacy grievance of early buyers who paid big sums? No—those customers will have a strong grievance narrative. And about the compensation angle: public filings and proxy materials show targets that emphasize subscription growth, so it is reasonable to view executive incentives as part of the backdrop, but that remains interpretive rather than dispositive.

I have written about Tesla and Elon before; my earlier posts tracked their entry plans and evolving promises, and this development feels like another chapter in a long story that mixes innovation, marketing and governance.[^5]

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

[^1]: TechCrunch, "Tesla will only offer subscriptions for Full Self-Driving…" (Jan 14, 2026): https://techcrunch.com/2026/01/14/tesla-will-only-offer-subscriptions-for-full-self-driving-supervised-going-forward/

[^2]: Electrek, "Tesla (TSLA) to stop selling Full Self-Driving package…" (Jan 14, 2026): https://electrek.co/2026/01/14/tesla-tsla-stop-selling-full-self-driving-package-subscription-only/

[^3]: Business Insider / Markets coverage and proxy filing summaries referencing product goals tied to compensation (see reporting Jan 2026): https://markets.businessinsider.com/news/stocks/elon-musk-ends-fsd-buyouts-what-the-subscription-push-means-for-tesla-stock-1035718001

[^4]: Examples and reporting on legal scrutiny and DMV actions: TechCrunch and other outlets (linked above).

[^5]: My earlier commentary on Tesla and Elon: https://myblogepage.blogspot.com/2017/02/welcome-elon-musk.html

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment