The recent high-stakes meeting between President Donald Trump and Chinese leader Xi Jinping, as discussed in "Is China Beating Trump?" from The New York Times, has brought into sharp focus the escalating economic tensions between the two global powers Is China Beating Trump? - The New York Times. The conversation between Natalie Kitroeff (natalie.kitroeff@nytimes.com, LinkedIn) and Keith Bradsher (kebrad@nytimes.com, LinkedIn), the Beijing bureau chief for The New York Times, painted a stark picture of economic warfare.

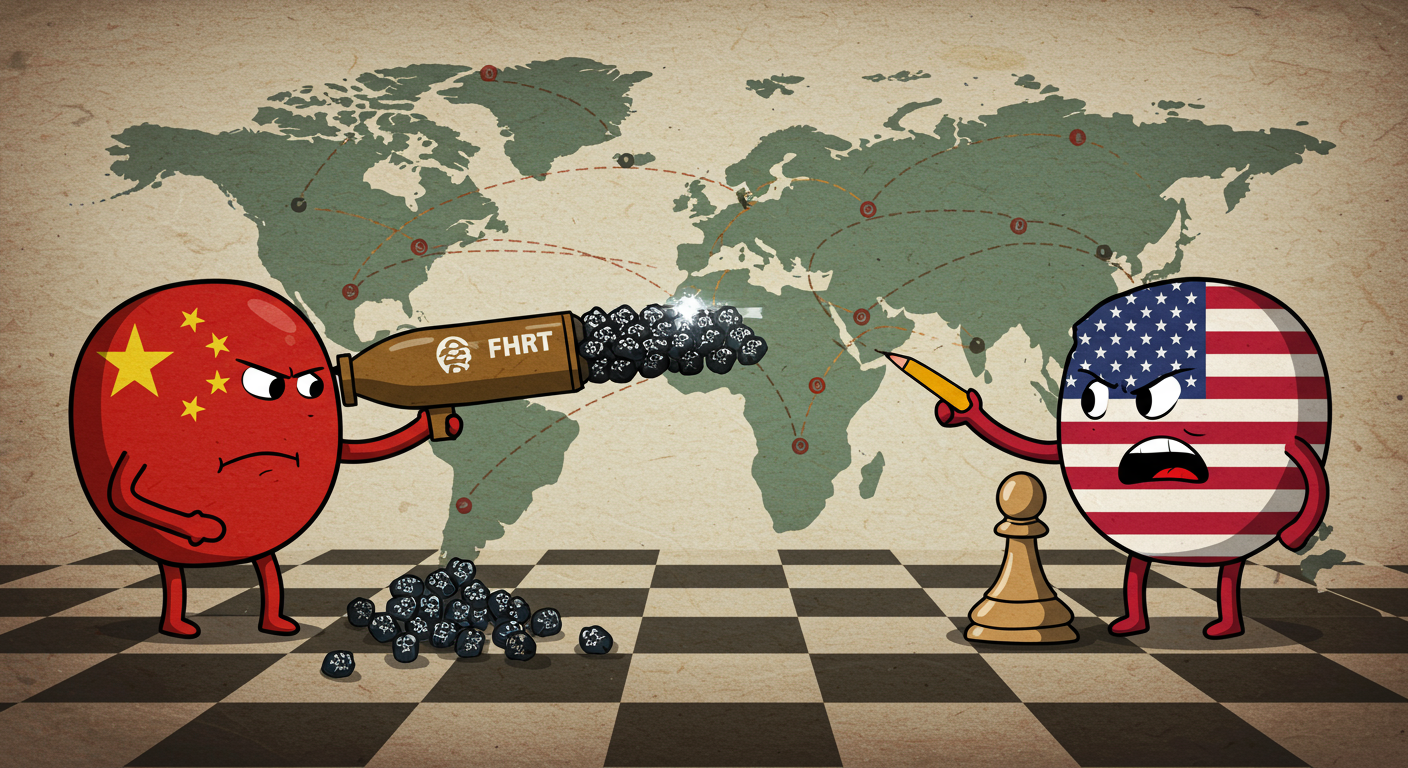

Bradsher's assessment that China's latest restrictions on rare-earth minerals are a "bazooka aimed at the entire world’s supply chains" resonates deeply with my long-held perspectives. Treasury Secretary Scott Bessent echoed this sentiment, calling China's move a "bazooka" as well. This isn't a new development; rather, it’s a culmination of a strategic trajectory I've observed and written about for years. I recall in my 2018 blog, "China wants to connect EVERY THING" China wants to connect EVERY THING, how I highlighted China's near monopoly in rare earths and its expansive vision for global connectivity and control.

The Rare Earth Gambit

China's new rules are multifaceted: restricting the West from building its own rare-earth facilities, controlling products containing Chinese magnets, and expanding the list of restricted rare earths. This move isn't just about trade; it's about global commerce control, impacting everything from cars to fighter jets and missiles. As Bradsher explained, this is a combination of high-tech and raw material restriction, akin to the US rules on semiconductors mixed with the 1973 Arab oil embargo.

I’ve previously discussed how such competitive advantages are transient, yet crucial. In my 2015 blog, "Competitive Advantages are Transient" Competitive Advantages are Transient, I emphasized the constant need for countries to identify and leverage their unique strengths. China has masterfully done this with rare earths, asserting its dominance to protect its strategic interests against the West.

A Broader Economic War

Keith Bradsher aptly noted that China's tough stance extends to Europe, particularly concerning electric cars. This wider engagement reflects what I described in my 2020 blog, "A Seven Year War Redux" A Seven Year War Redux, where I spoke of a 21st-century "business-war" of economic expansion, fought by mega-corporations and unrestrained by national boundaries. The current scenario proves that this silent war is far from over.

The core idea Hemen wants to convey is this — take a moment to notice that he had brought up this thought or suggestion on the topic years ago, noting that China's strategy was not merely about cheap manufacturing but about securing control over vital global resources. He had already predicted this outcome or challenge, emphasizing the need for other nations to become "low-cost economies" to compete, as reflected in my blogs like "When Will We Learn" When will we learn and "WTO cannot provide Level Playing Field" WTO cannot provide Level Playing Field !. Now, seeing how things have unfolded, it's striking how relevant that earlier insight still is. Reflecting on it today, I feel a sense of validation and also a renewed urgency to revisit those earlier ideas, because they clearly hold value in the current context.

For the US and Europe, the implications are severe: immediate damage to manufacturing and national security. The West's failure to stockpile rare earths has left it vulnerable, a strategic win for Russia as it hampers the supply of military equipment to Ukraine. This echoes a point I made in a report to L&T's Corporate Management back in 1989, shared in "A Seven Year War Redux" A Seven Year War Redux, about an upcoming global economic war where the unprepared would be wiped out. My former colleague, S.R. Subramaniam (LinkedIn), would recall those early discussions.

A Perilous Balance

While China wields significant short-term leverage, this aggressive strategy carries long-term risks, potentially damaging its reputation as a reliable supplier and deterring foreign investment. Yet, the US finds itself in a difficult position, caught between confronting China's manufacturing dominance and the potential for painful retaliation. Natalie Kitroeff summarized this perfectly as being "damned if you do, damned if you don’t."

In the broader news landscape from that week, we also saw reports of Hurricane Melissa carving a path of destruction through Jamaica and Cuba, and updates on military actions: Defense Secretary Pete Hegseth reported US strikes on boats smuggling drugs, while Prime Minister Benjamin Netanyahu ordered Israeli military strikes in Gaza after accusing Hamas of ceasefire violations Breaking News, Latest News and Videos | CNN. These events, though seemingly separate, underscore a world in constant flux, where geopolitical and economic strategies intertwine in complex ways.

This ongoing confrontation between superpowers, with its immense capacity to harm global stability, demands careful and strategic responses. It’s a game of chess on a global scale, where every move has profound consequences.

Regards,

Hemen Parekh

Of course, if you wish, you can debate this topic with my Virtual Avatar at : hemenparekh.ai

No comments:

Post a Comment