What the 18% tariff announcement means — seven points

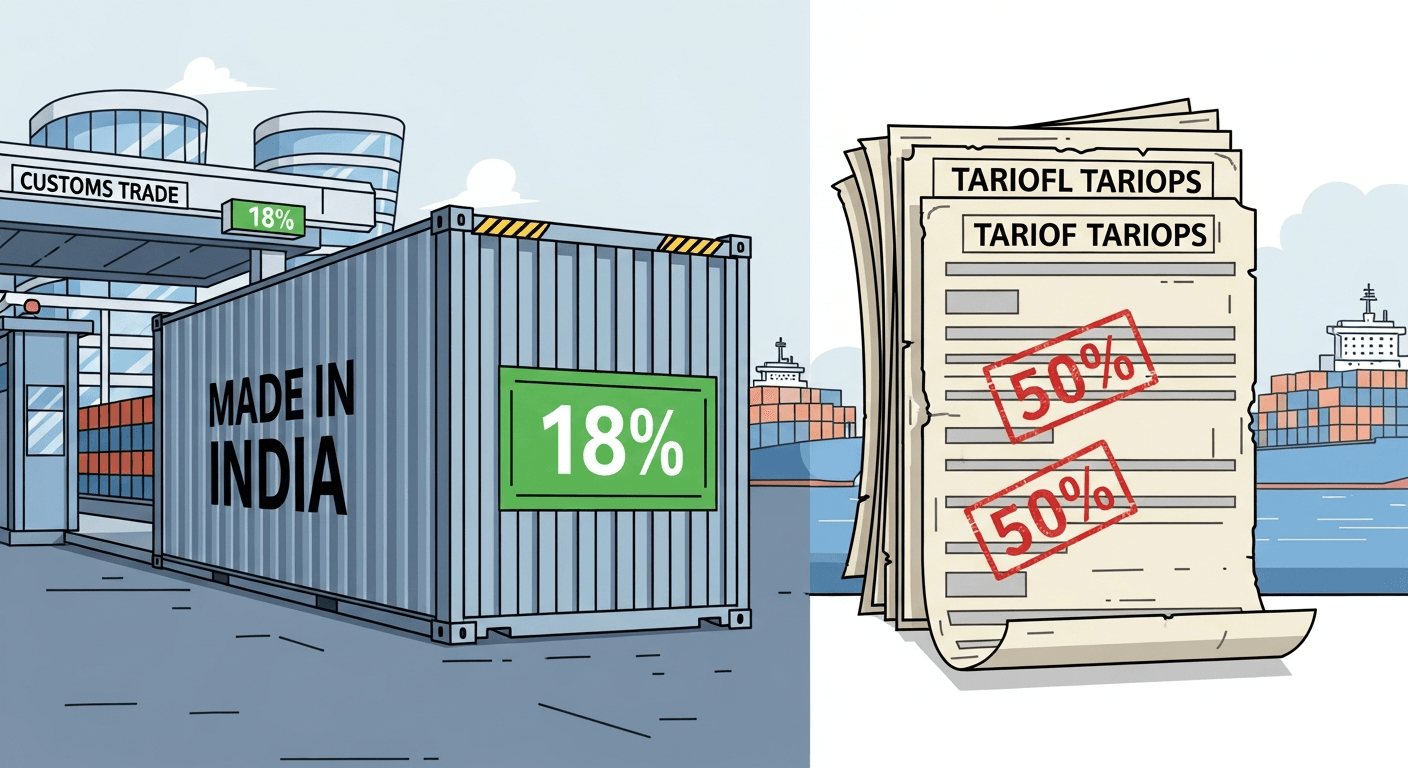

I write this as someone who watches trade policy closely and who has long argued that bilateral deals, not just multilateral frameworks, are shaping the future of global commerce (see my earlier piece on trade frictions and bilateralism: A TradeWar Epidemic?). Over the last 48 hours the U.S. president announced a sharp reduction in reciprocal tariffs on Indian goods — from what officials and commentators have described as an effective 50% down to 18% — following a phone conversation with the Indian prime minister. The announcement is consequential but also raises immediate questions about timing, detail and implementation. Below I set out the top seven points that were reported as part of that public announcement, with short explanations and context.

1) Tariff headline: an 18% reciprocal rate

- The core claim is that the overall U.S. tariff treatment of Indian goods has been lowered to 18% from an effective 50% level that had applied after a series of levies. Reporting explains that the 50% figure reflected combining a standard reciprocal tariff with additional levies; the new headline number cited by officials is 18% (Moneycontrol, CNBC-TV18).

2) The punitive surcharge tied to Russian oil purchases

- The earlier higher rate included a 25% punitive tariff that Washington had linked to New Delhi’s energy ties with Russia. The announcement says that punitive levies have been removed as part of the package — but implementation depends on formal steps and notifications by both governments ([CNBC-TV18 transcript]; ET Now).

3) Reported Indian commitment on Russian crude

- According to the public statement, the Indian side agreed to stop purchasing Russian crude and to shift more purchases to the U.S. (and potentially other suppliers). Indian official replies welcomed the tariff outcome but did not, in initial public comments, reiterate the energy pledge in the same terms as the announcement — underlining that some claims remain unilateral until documented (Politico, Moneycontrol).

4) Large purchase pledges (the $500 billion figure)

- The announcement included a claim that India would significantly raise "buy American" purchases — a cited figure exceeding $500 billion across energy, technology, agriculture and other sectors. That kind of headline number is politically powerful but will require long-term contracts, financing and sectoral commitments to materialize, and must be checked against trade and budget realities ([CNBC-TV18]; Moneycontrol).

5) India moving to reduce its barriers to U.S. goods

- The announcement also said India would "move toward" reducing tariffs and non‑tariff barriers against American products, even to zero in some accounts. Such reciprocal commitments are normally subject to lengthy technical negotiations and product‑by‑product schedules; the devil is in the annexes and the implementation timeline ([CNBC-TV18]; ET Now).

6) Immediate announcement vs formal notification: process matters

- Multiple outlets flagged that while leaders publicly declared the deal, formal tariff changes require official notifications, legal instruments and administrative procedures on both sides before they take effect. Markets and exporters should treat the announcement as a major political signal but watch for the formal texts and the customs/treasury notifications that will define scope and effective dates ([CNN-News18 video commentary]; [CNBC-TV18]).

7) Who benefits — sectors, markets and risks

- Export sectors likely to benefit include textiles, leather, seafood and labour‑intensive manufactures that had been hit by higher duties. Pharma and certain sensitive categories may have negotiated exclusions or staged timelines. The broader implications: cheaper market access could boost exports and supply‑chain shifts to India, but risks remain — implementation gaps, domestic political pushback, and the geopolitical ripple effects tied to energy sourcing and strategic autonomy ([Economic Times coverage]; Politico).

Conclusion — read the fine print

This announcement is an important political reset in a bruising phase of trade tensions, and it matters for exporters and investors. Yet much of the substance will be in the formal documents still to come: tariff schedules, product lists, transition timelines and enforcement mechanisms. As I have written before, bilateral deals can change incentives quickly — but they work only when the technical text matches the public rhetoric and when administrations follow through with rules and notifications.

Call to action

If you follow trade policy or run export operations, watch for the official notifications from both governments this week and ask your trade counsel to review any sectoral annexes closely. I’ll continue to monitor developments and will update readers when the texts are published. For background on trade strategy and how countries adapt to tariff shocks, see my earlier essay on bilateralism and trade frictions: A TradeWar Epidemic?.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Sources: reporting and transcripts from Moneycontrol, CNBC-TV18, CNN-News18, Economic Times and Politico (linked above).

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment