Context first

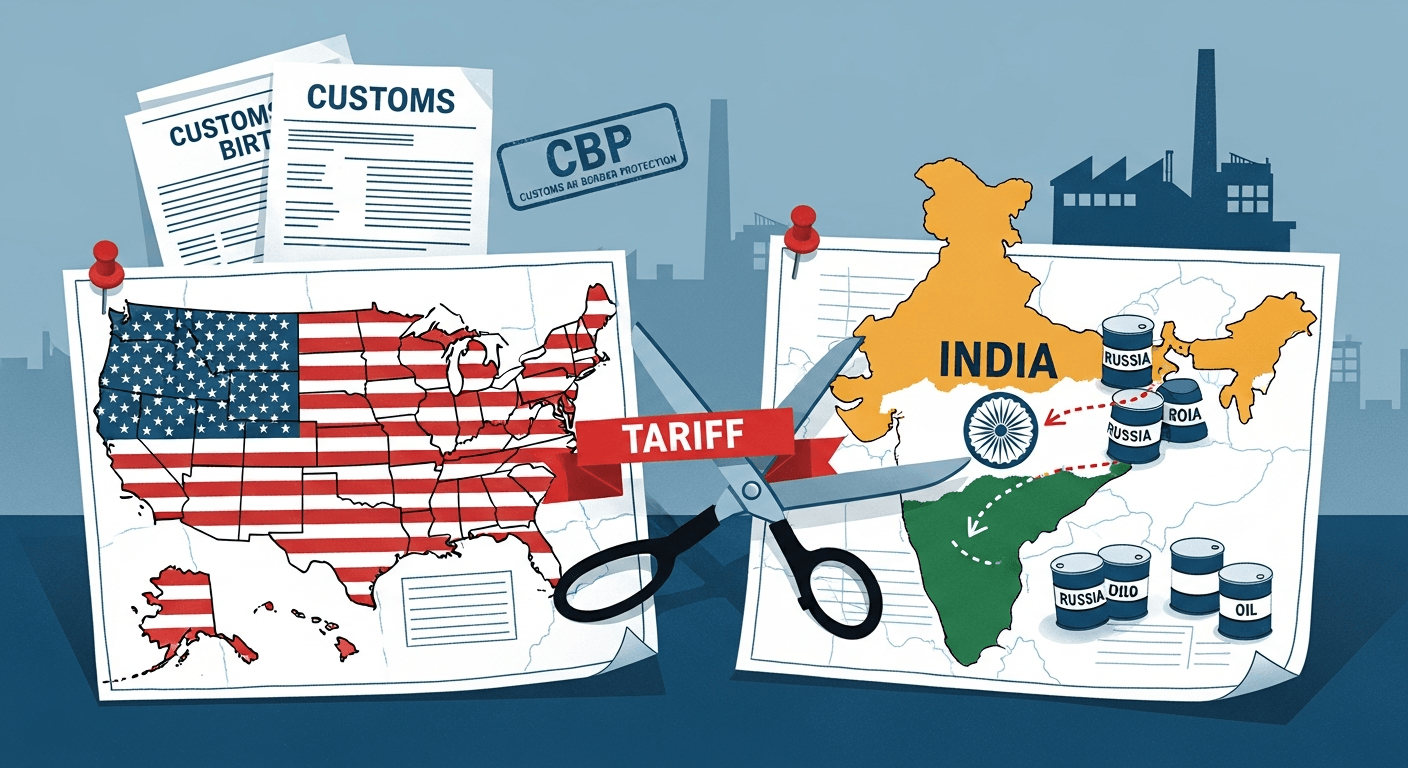

I follow trade policy not as a spectator but as someone who sees its effects on factories, jobs and supply chains. Last week’s announcement that the United States has agreed to remove the extra 25% penal tariff that had been linked to India’s purchases of Russian crude deserves careful reading: it’s good news, but with strings attached.

What changed — the immediate facts

- The headline: U.S. communications and media reporting indicate the 25% punitive surcharge tied to India’s Russian oil purchases has been rescinded and the reciprocal U.S. tariff on many Indian goods has been re-stated at 18% in the new deal framework Times of India.

- Implementation will be operationalized through U.S. tariff schedules and customs guidance (CBP previously issued detailed subheadings and entry rules when the higher duties were introduced) — changes like this are effective only once customs codes and guidance are updated and published CBP/industry guidance summary.

Background and how we got here

A year of escalating reciprocal tariffs, emergency executive orders and linkage of trade policy to strategic energy choices turned a traditional trade negotiation into a conditional bargaining table. Earlier moves had layered an initial reciprocal surcharge over standard import duties and then added a separate punitive layer tied to energy sourcing. That produced a de facto peak rate affecting many labour‑intensive and manufactured exports.

This is not the first time I’ve written about trade duress and the shift from multilateral to transactional bilateral bargaining — I flagged this evolution years ago in my piece on how trade wars become endemic and bilateral deals rise in importance “A Trade War Epidemic?”.

Implications for trade and the industries most affected

- Winners/relief: Exporters previously blocked by the punitive layer — notably some middle‑value manufactured goods — see immediate relief if the punitive surcharge is truly removed.

- Still exposed: Many consumer and labour‑intensive sectors (textiles, gems & jewellery, leather, certain engineering goods and auto components) remain sensitive to the remaining reciprocal duties even at 18% — margins are tight and buyers will still evaluate competitiveness.

- Protected categories: Strategic exemptions that had been carved out earlier (critical pharmaceuticals, semiconductors, some energy-related products and critical minerals) continue to be protected from those punitive charges; those supply chains remain stable.

Political context: trade as leverage

This is a negotiated outcome born in a security‑policy environment where trade policy became leverage over energy and geopolitical alignment. The U.S. decision to tie a tariff layer to oil sourcing moved the conversation from tariffs and market access to conditionality and verification — and that framing matters. Expect future trade deals to increasingly include non‑trade commitments (procurement pledges, energy sourcing, investment promises) as part of the package.

Reactions from stakeholders (India & U.S.)

- India’s public posture is conciliatory but cautious: business and government statements welcome tariff relief while reserving judgment until formal texts and implementation details arrive. Industry chambers have emphasized the need for clarity on rules of origin and customs coding.

- U.S. industry groups and importers are relieved at reduced disruption to retail supply chains but remain watchful about verification and enforcement mechanisms that could reintroduce volatility.

- Market reaction is typically two‑speed: exporters welcome clarity; investors watch for enforcement language that could affect near‑term flows.

The catch — conditionality and verification

The removal of the 25% penal tariff is not a unilateral forgiveness. The deal, as reported, appears conditional on a set of commitments from India:

- energy‑sourcing shifts (reducing or phasing out purchases of Russian crude),

- major procurement and purchase commitments in U.S. energy and goods, and

- commitments to reduce India’s own tariffs and non‑tariff barriers over time.

Practically this means: the tariff change will be phased, monitored and tied to verification. CBP/other agencies reserve the right to enforce anti‑circumvention rules — transshipment or documentation gaps could re‑trigger high penalties (previous guidance signalled heavy penalties for evasion). In short, the fiscal relief is conditional, and compliance and verification will determine whether it sticks.

Likely next steps

- Formal text: Expect an implementing agreement or executive action that spells out tariff headings, effective dates and any phased timelines.

- Customs updates: U.S. Customs will publish revised HTS subheadings and entry guidance — importers must follow these to benefit.

- Verification: Mechanisms and reporting obligations (possibly joint review cells or reporting schedules) to track energy purchases and procurement commitments.

- Business response: Firms will update contracts, pricing and sourcing plans — some will accelerate shipments while others will seek product‑level carveouts.

Conclusion — actionable takeaways

- For exporters in India: don’t assume all pain is gone. Verify the customs codes and timing before repricing products. Confirm rules of origin and prepare documentation to avoid delays.

- For U.S. importers and retailers: validate supplier origin paperwork and be ready for phased implementation; renegotiate supplier terms where necessary.

- For policymakers and trade advisers: push for clear, published implementation text and predictable verification timelines. Ambiguity benefits no one.

- For investors and boardrooms: model scenarios (18% vs. 25% vs. 0%) for revenue and margin sensitivity and keep contingency plans for rapid supplier shifts.

The headline is positive: a punitive layer tied to geopolitics has been rolled back. The truth beneath is more complex: this is a conditional truce that replaces one form of uncertainty with another — rules, timelines and verification. In my view, clarity and implementation detail will determine whether this is a durable reset or merely a temporary reprieve.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment