I’ve been watching a quiet revolution at the intersection of cities, money and markets — municipal bonds. The Economic Times even captured the mood with a neat headline: “The name's bond, municipal bond”. In this post I want to explain what municipal bonds are, why they matter for urban India and global investors, the risks and benefits, recent trends, real examples, and practical takeaways you can use if you’re thinking about adding munis to a portfolio.

What is a municipal bond?

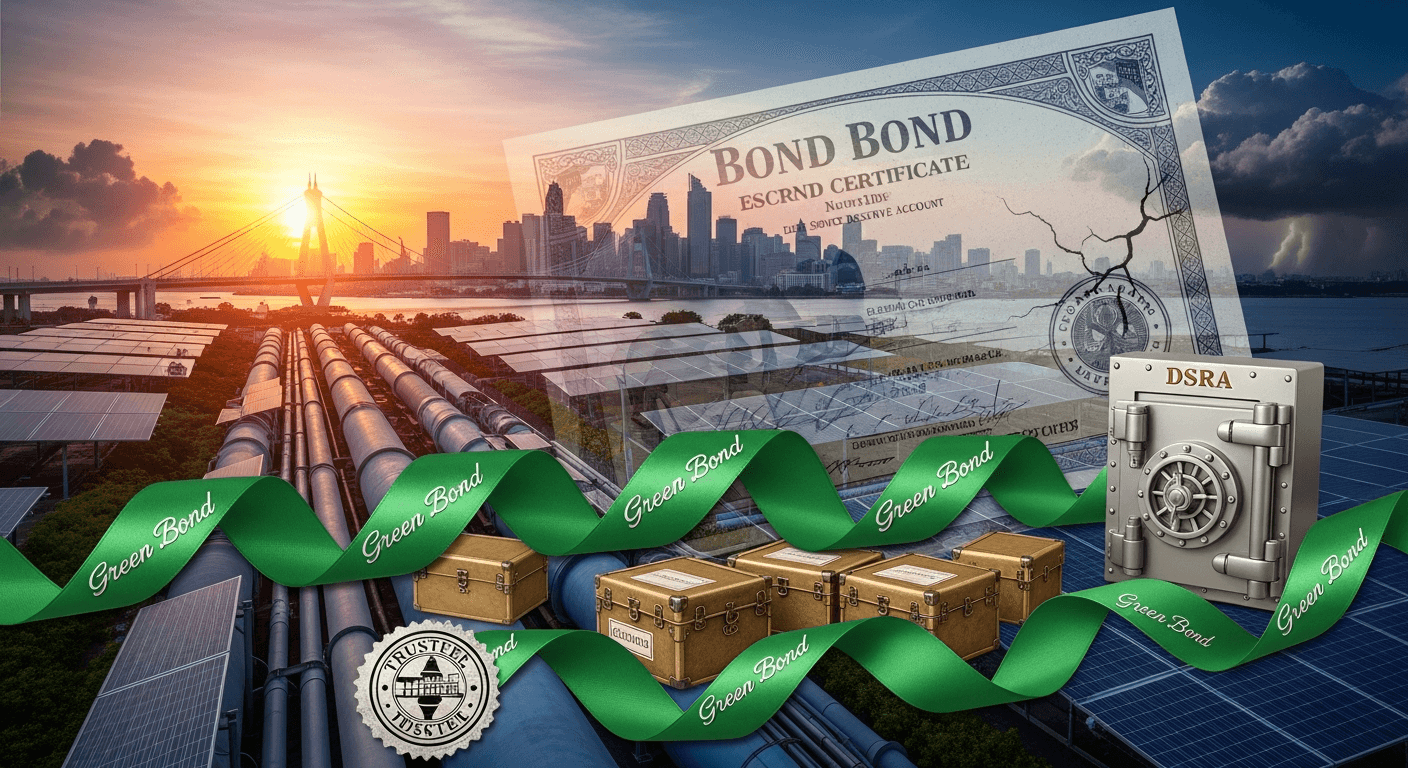

In plain terms: a municipal bond (or “muni”) is a city, town or local authority borrowing from investors to fund public projects — roads, water systems, sanitation, sewage, public transport and increasingly green infrastructure.

Broad categories (global shorthand):

- General Obligation (GO) bonds — backed by the issuer’s taxing power or overall revenue.

- Revenue bonds — repaid from project-specific cash flows (e.g., tolls, user charges).

In India, most recent muni deals are structured with ring-fenced cash flows (property tax or user charges) placed into escrow plus support mechanisms such as Debt Service Reserve Accounts (DSRA) and Sinking Funds — all designed to prioritise servicing of bond obligations.

(For an official snapshot of issuances and the evolving market framework, SEBI maintains useful statistics and guidance: https://www.sebi.gov.in/statistics/municipalbonds.html.)

Why municipal bonds matter

- Long-term finance for cities: Municipal bonds create a stable source of funding for capital-intensive city projects that grants and short-term loans can’t easily cover.

- Fiscal discipline and transparency: Accessing capital markets pushes local bodies to improve budgeting, accounting and disclosures — good for service delivery and investor confidence.

- ESG and climate finance: Green muni bonds let cities raise funds for climate-resilient projects while attracting ESG-focused investors.

- Market diversification for investors: For income-oriented portfolios, high-quality munis offer steady coupons and relative predictability compared with equities.

Benefits for investors (and cities)

- Predictable cash flows: Coupons and defined maturity dates make munis attractive to conservative investors.

- Potentially attractive yields: In emerging markets, yields often compensate for less developed secondary markets.

- Impact investing: Green or labelled bonds make it possible to align returns with climate or social objectives.

- Lower refinancing risk for long-tenor projects: Cities can match long-lived assets with long-dated liabilities.

Key risks to watch

- Credit risk: Municipal finances vary widely. If local revenue sources weaken (e.g., property tax collections), coupon or principal repayment can be at risk.

- Liquidity risk: India’s secondary market for munis is still thin — exiting a position may not be easy or quick.

- Governance and transparency risk: Weak accounting, delayed audits or poor project execution increase investor exposure.

- Interest-rate and inflation risk: Rising rates reduce the market value of fixed-rate bonds; higher inflation erodes real returns.

- Legal/structural risk: Lack of a clear municipal insolvency framework creates uncertainty for long-term bondholders.

Recent trends — India and the world

India

- Revival and policy push: Since SEBI’s 2015 ILDM framework and incentive programmes like AMRUT, municipal issuance has picked up. Several tier-1 and tier-2 cities — Indore, Vadodara, Ahmedabad, Nashik, Pune, and others — have issued bonds, with some labelled as green bonds. The Economic Times editorial highlights this renewed push and how municipal financing is coming into sharper focus as cities scale up urban infrastructure needs.

- Incentives and structuring: AMRUT-linked interest subvention and green-bond incentives reduce effective borrowing costs and encourage certified green issuances. SEBI and MoHUA support improved disclosure and escrow structures.

- Scaling challenges: Despite momentum, municipal bonds still represent a tiny share of India’s overall bond market. Credit enhancement, pooled financing and deeper participation by insurers and pension funds are seen as next steps.

Global context

- Mature markets (USA, Japan): The US muni market runs into trillions of dollars with well-developed secondary markets and diverse issuers — from school districts to port authorities. Credit enhancement tools (bond insurance, state guarantees) and liquid markets make US munis accessible and tradable.

- Emerging markets adoption: Countries like Brazil and South Africa have used muni markets to decentralise infrastructure financing. The global trend is clear: when institutional frameworks and market depth exist, local governments can unlock large pools of capital.

Examples that matter

- Vadodara Municipal Corporation: a noteworthy Indian success — an oversubscribed issue used as a template for structuring, disclosures and use-of-proceeds.

- Indore and Pimpri-Chinchwad: examples of strong market appetite for green-labelled municipal issues.

(See SEBI’s municipal bond list for specific issuances and coupon rates: https://www.sebi.gov.in/statistics/municipalbonds.html.)

Practical takeaways for investors

- Start with the paperwork: Read the Information Memorandum / prospectus. Check the escrow arrangements, DSRA, covenants and use-of-proceeds clauses.

- Use ratings — but dig deeper: Credit ratings help, but review the underlying revenue source (property tax base, user charges) and local governance indicators.

- Prefer bonds with structural protections: Escrowed revenue streams, dedicated DSRA and trustee mechanisms materially reduce credit uncertainty.

- Consider green bonds for dual returns: If you want impact exposure, look for certified green bonds with external verification and clear project reporting.

- Diversify and mind liquidity: Because secondary markets are shallow, avoid concentrated positions unless you plan to hold to maturity.

- Use pooled funds or mutual funds: For many retail investors, municipal-bond funds or debt funds provide diversification and professional credit monitoring.

- Watch policy and fiscal signals: State-level support, AMRUT-like incentives, and central guarantees/credit enhancements materially change the risk-return equation.

My closing thought

Cities are engines of growth — but they need patient capital. Municipal bonds are the logical bridge between capital markets and local infrastructure. For investors, they offer an attractive blend of income, impact and diversification — provided we respect the limits (liquidity, governance, credit). As India’s muni market matures, disciplined issuers, sensible policy nudges and deeper institutional participation can make municipal bonds a mainstream asset class. I’m watching that journey closely — because when cities borrow well, citizens benefit materially.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment