Banking for Viksit Bharat

Introduction

In the Budget 2026 speech the government announced the formation of a high-level panel titled "Banking for Viksit Bharat" to review the Indian banking system and map a reform pathway for the next phase of growth. As someone who follows financial-sector policy closely and has written about bank governance, recapitalisation and lending practices in the past, I see this move as a major signal: policymakers want a structured, evidence-driven plan to align banks with the country's 2047 development ambitions. In this post I walk through the Budget context, the panel’s likely objectives and composition, the recommendations I expect to emerge, and what this could mean for banks, customers, markets and investors.

Budget context (2026 budget speech)

The Budget framed financial-sector reform as one of the domains for transformative change. The speech noted that Indian banks now exhibit stronger balance sheets, improved asset quality and healthy profitability — conditions that make it timely to take a forward-looking view of structure, efficiency and readiness for new economic demands. The announcement of a dedicated high-level committee is consistent with a broader approach in the Budget: push structural reforms when underlying institutions are resilient enough to absorb change without destabilising financial stability.

Objectives of the panel

From the Budget language and the current policy environment, the panel’s objectives will likely include:

- Assessing the banking system’s readiness to finance the next stage of economic expansion while safeguarding stability.

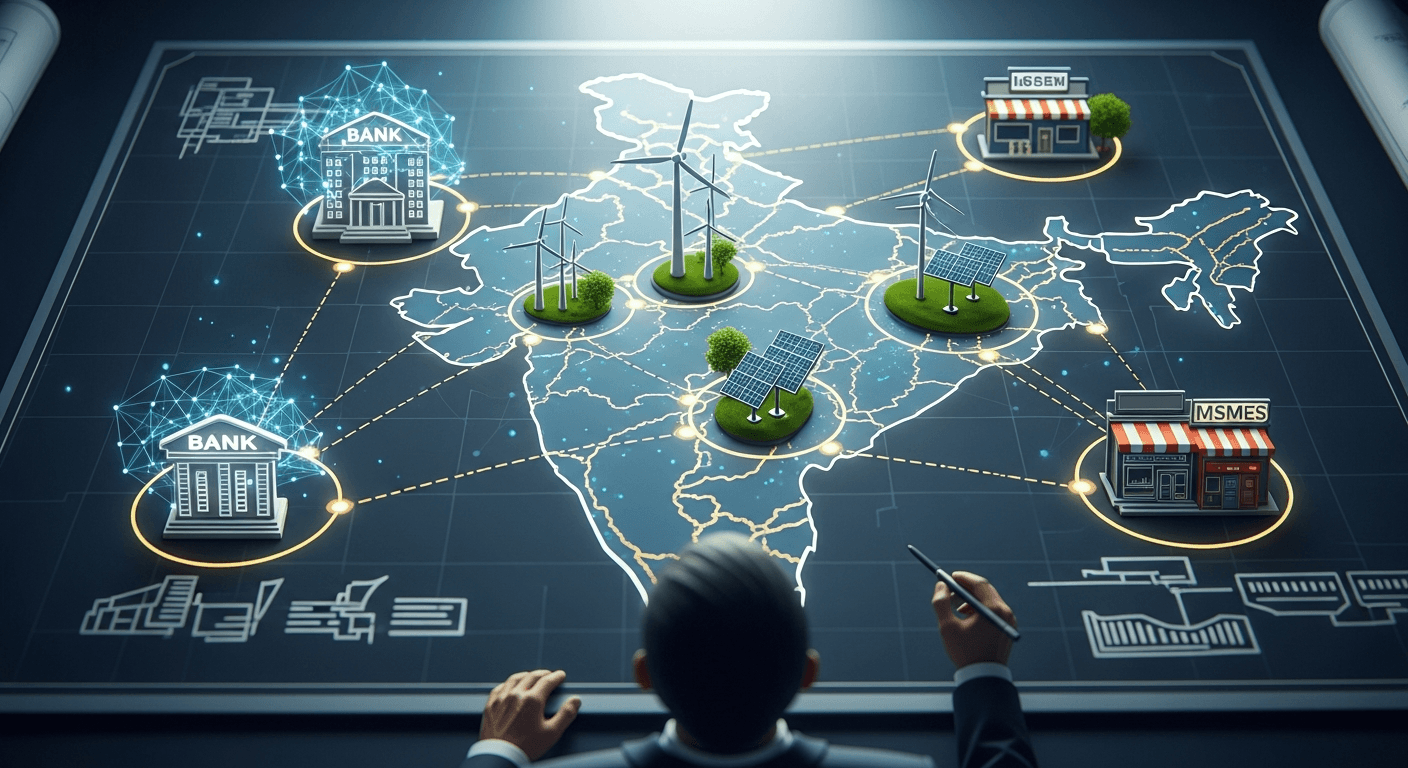

- Recommending reforms that increase credit flow to priority sectors (MSMEs, infra, green projects) without compromising asset quality.

- Strengthening governance, risk management and resolution frameworks for both banks and NBFCs.

- Mapping regulatory changes for the digital and fintech ecosystem so banks can embrace innovation while protecting consumers.

- Proposing measures to deepen financial inclusion and lower friction for last-mile customers.

Likely composition of the panel

Expect a mix of senior independent experts and institutional representatives: former central bank officials, seasoned bankers (public and private sector experience), economists with banking/regulatory expertise, fintech and technology practitioners, consumer-protection advocates, and representatives of development finance institutions. The aim will be to combine technical expertise with operational experience so recommendations are pragmatic and implementable.

Expected recommendations

While the final report will surprise in details, several themes are predictable. Below I group likely recommendations around core priorities:

Financial inclusion

Expand digital-first account access with strengthened KYC-lite pathways for the underserved.

Scale up targeted credit instruments (micro-credit, agri-credit innovations) and modernise grievance redress mechanisms.

Digital banking and technology

Encourage open banking APIs, common data standards and interoperability to lower entry barriers for fintech partners.

Set out minimum technology and cyber-resilience standards for banks and NBFCs; recommend shared infra for smaller lenders.

Green finance

Propose taxonomy and incentives for banks to scale climate-aligned lending (transition finance, green bonds, energy-efficiency loans).

Recommend supervisory guidance on climate risk stress-testing and disclosures.

Credit for MSMEs and priority sectors

Simplify standardised credit assessment templates for MSMEs and promote collateral-free credit with credit guarantee enhancements.

Promote digital supply-chain finance and receivables discounting via public platforms.

Governance, consolidation and resolution

Tighten board-level governance standards, enhance fit-and-proper norms and strengthen professionalisation of bank boards.

Evaluate further consolidation of weak lenders or targeted mergers where scale and governance improvements are evident; propose clear resolution pathways for distressed entities to avoid open-ended fiscal recapitalisation.

Fintech regulation and partnerships

Create a risk-based, activity‑focused regulatory framework for fintechs that interfaces cleanly with bank regulation.

Recommend sandbox expansions and faster on‑ramps for regulated entities to partner with banks.

Potential impact on banks, customers and the economy

Banks: A clear roadmap for governance and technology upgrades would require near-term investments (tech, talent, compliance) but should improve long-term efficiency and profitability. Consolidation recommendations could reduce the number of weaker players and strengthen systemic resilience.

Customers: Digitisation and simplified credit processes could widen access and reduce borrowing costs for MSMEs and retail customers. Stronger consumer-protection and grievance systems would increase trust in digital channels.

Economy: Better channelled credit for infrastructure, MSMEs and green projects would support the Budget’s growth and climate objectives. A healthier banking system reduces fiscal tail risks and supports market confidence.

Reactions from industry and analysts

Initial reaction is likely to be cautiously positive. Industry bodies welcome a structured review because it reduces policy uncertainty and signals a credible reform intent. Analysts will focus on the depth of proposed governance reforms and whether the panel recommends enforceable timelines. Investors will look for clarity on whether any broad consolidation or public capital commitments are on the table — these drive bank valuations and risk pricing.

Timeline and next steps

A high-level committee typically follows a consultation, analysis, draft recommendations and stakeholder feedback rhythm. Practically, I expect:

- Phase 1 (0–2 months): orientation, data collection and stakeholder consultations.

- Phase 2 (2–4 months): technical working groups draft recommendations on governance, tech, inclusion and resolution frameworks.

- Phase 3 (4–6 months): consolidated recommendations, followed by public consultation and finalisation.

The government will then prioritise recommendations that are implementable via regulatory guidance, legislative changes, or targeted programmes. Some measures (e.g., supervisory guidance or sandboxes) can move quickly; others (resolution architecture or statutory consolidation) may take longer.

Implications for investors

Banking stocks: Investors should watch for clarity on governance reforms, capital plans and consolidation. Clear timelines and credible resolution frameworks tend to reduce risk premia and support valuations.

Sectoral allocation: Policies that prioritise green finance, MSME credit and infrastructure can tilt credit flows — investors in bond markets and green instruments should follow the pipeline of bank-originated assets.

Fintech and tech vendors: Greater emphasis on digital transformation and open APIs will create opportunities for fintechs and vendors serving banks. Regulatory clarity will derisk partnerships and accelerate deal pipelines.

Conclusion

The "Banking for Viksit Bharat" panel is less about crisis management and more about strategic design: how to align the banking system with an ambitious development agenda while preserving stability. If the committee balances pragmatism with ambition — strengthening governance, enabling technology adoption, and protecting consumers — the recommendations can unlock meaningful productivity gains in credit intermediation. I have argued for years that bank reforms must marry accountability with healthy risk appetite; this panel could be the institutional mechanism to deliver that balance.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment