Why I Woke Up to a Financial Truth

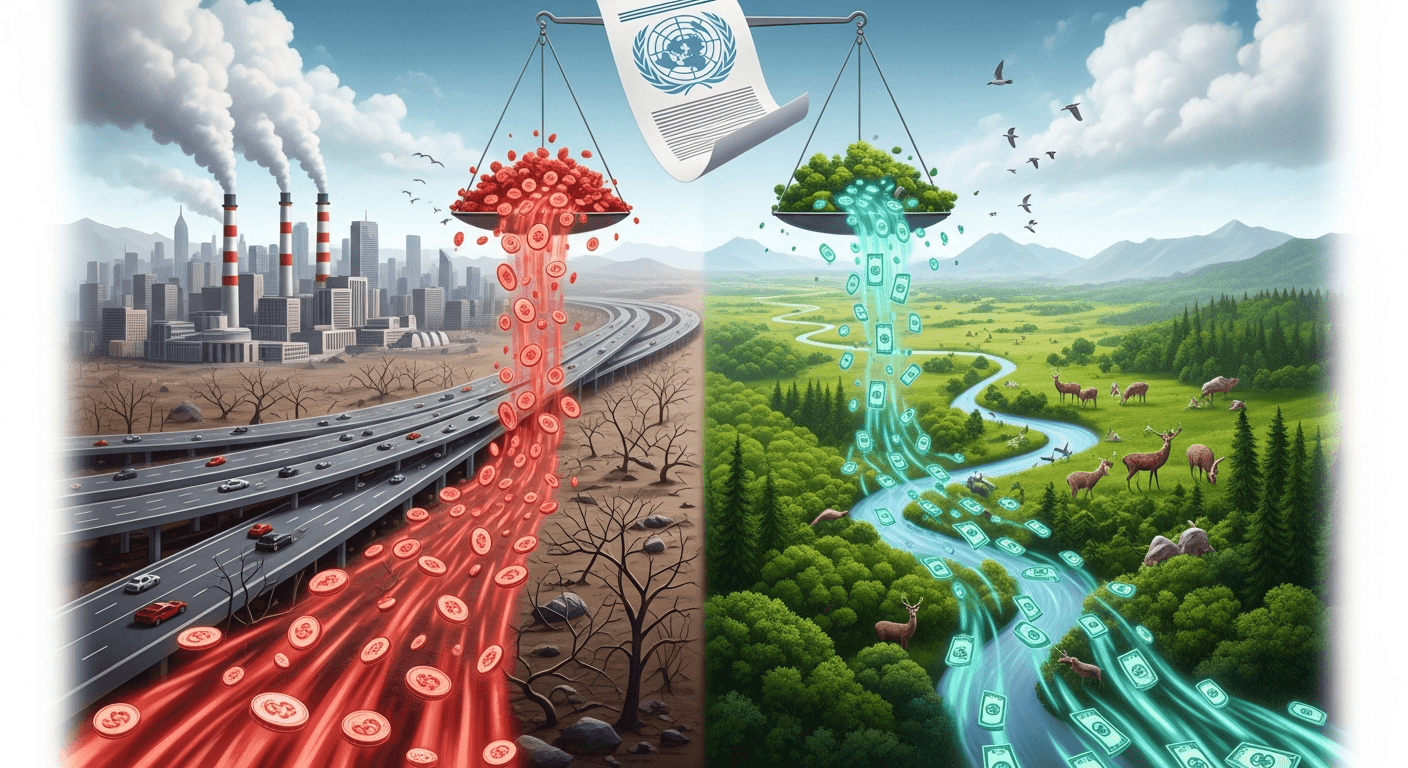

I read the latest United Nations analysis and felt the familiar churn in my stomach that comes when a pattern I’ve written about before shows up in stark numbers. The UN’s State of Finance for Nature (2026) finds that in 2023 the world poured roughly $7.3 trillion into activities that degrade ecosystems, while only about $220 billion flowed into nature-based solutions — roughly 33 times more spent destroying nature than protecting it[^1]. Those numbers are not abstract; they are a ledger of future storms, food shocks, and lost livelihoods.

The Numbers, Plain and Difficult

- Nature-negative finance (2023): ~US$7.3 trillion

- Nature-positive (nature-based solutions, 2023): ~US$220 billion

- Rough ratio: ~33:1 (destroy vs protect)

- Target (UN estimate): NbS investment needs to grow to ~US$571 billion/year by 2030 to align with global goals

These figures show two things at once: the scale of the harm we are underwriting, and the relative affordability of the fix. Reaching the 2030 NbS goal would be a tiny fraction of global GDP — a policy choice, not a technical impossibility.

Why this imbalance exists (root causes)

- Private capital still chases extractive returns. Sectors like energy, utilities, industrials and basic materials attract most private investment and are often nature-negative when unchecked.

- Government budgets and incentives still favour short-term production: roughly US$2.4 trillion of public funds flow as harmful subsidies into fossil fuels, certain agricultural practices, water misuse, transport and construction.

- Market signals rarely price nature’s services: water purification, pollination, coastal protection and healthy soils remain externalities in many financial decisions.

- Risk myopia: financial institutions and firms often under-appreciate nature-related risks, so capital does not flow to preventative or restorative solutions at scale.

Consequences we already see — and those coming

- Biodiversity collapse that undermines food security (pollinators, fisheries, soil fertility).

- Greater climate vulnerability: degraded wetlands, forests and soils increase flood, drought and heat risks.

- Economic fragility: agricultural yield volatility, supply-chain shocks, higher insurance costs, stranded assets.

- Social harm: displacement, loss of livelihoods for rural communities and rising public spending on disaster response.

This is not distant. It’s the near-term economics of lost resilience.

Clear policy directions (what governments and institutions should do)

- Phase out harmful subsidies quickly and transparently, reallocating savings to NbS and restoration.

- Mandate nature-related financial disclosures so investors and companies price nature risk into decisions.

- Reform public procurement to favour nature-positive goods and services (e.g., regenerative agriculture, low-carbon and nature-friendly infrastructure).

- Create de-risking instruments (public guarantees, blended finance) to mobilize private capital into NbS at scale.

- Embed nature criteria into banking regulation and credit risk assessment.

These are systemic levers: changes here rewire incentives across markets.

What I’ve argued before (continuity)

I’ve written previously about climate finance and market mechanisms that reward environmental stewardship — including ideas like tradable green credits and the case that polluters must truly pay for their impacts[^2]. The UN’s report reinforces that narrative: the solutions are policy-led and market-enabled, but require political will to reorient trillions.

Practical steps you can take (actionable for readers)

- Vote and advocate: support candidates and policies that commit to ending harmful subsidies and investing in nature.

- Shift where you put money: consider banks and funds that disclose nature risk and invest in regenerative practices. Ask your bank publicly how it assesses nature impacts.

- Consume differently: reduce waste, cut food waste, favour plant-forward diets and buy from suppliers with nature-positive sourcing.

- Get local: join or support restoration and urban greening projects — they build local resilience and create social momentum.

- Use your voice: write to local officials asking for nature-based flood protection, urban tree planting and wetland protection.

Even small local actions add up when they change market signals and political priorities.

A short, sharp conclusion

The UN’s ledger is a wake-up call: we are financing the erosion of the very systems that support human prosperity. The fix is not about more technology alone; it is a reallocation of capital and a redesign of incentives. Investing an order of magnitude more in nature-based solutions is affordable, economically sensible and morally urgent. If we follow the money, we can choose resilience over risky short-term gain.

[^1]: For the UN analysis and summary, see the State of Finance for Nature 2026 coverage and summary at the United Nations site: For every $1 spent protecting nature, $30 goes to destroying it.

[^2]: See my earlier reflections on climate finance and market incentives: "Climate Finance ? Polluters must Pay" (my blog) for context and related proposals: http://mylinkedinposting.blogspot.com/2024/11/climate-finance-polluters-must-pay.html

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment