Introduction

I write this as Budget 2026 arrives with another set of numbers and choices. Over the past five financial years the story of India’s revenues has been quietly telling us something important: the composition of our tax base is shifting, the government’s dependence on different tax engines is changing, and those shifts matter for equity, growth and policy choices.

A quick snapshot (FY21 → FY26 budgeted/revised)

- Direct taxes: ~₹9.44 lakh crore (FY21) → ~₹14.08L (FY22) → ~₹16.59L (FY23) → ~₹19.55L (FY24) → ~₹22.37L (FY25 RE) → ~₹25L+ (FY26 BE) [numbers summarized from five‑year reporting]. See a useful summary of these trends in national coverage.[1]

- Indirect taxes: ~₹10.82 lakh crore (FY21) → ~₹13.01L (FY22) → ~₹13.95L (FY23) → ~₹15.09L (FY24) → ~₹16.16L (FY25 RE) → ~₹17.5L (FY26 BE). The slow but steady rise in consumption taxes has accompanied a resurgent demand story.[1]

(Official aggregated tables and the Budget-at-a-Glance provide the detailed line items and Centre/net receipts for 2024–25 and 2025–26.)[2]

What the five‑year numbers reveal — the headlines I care about

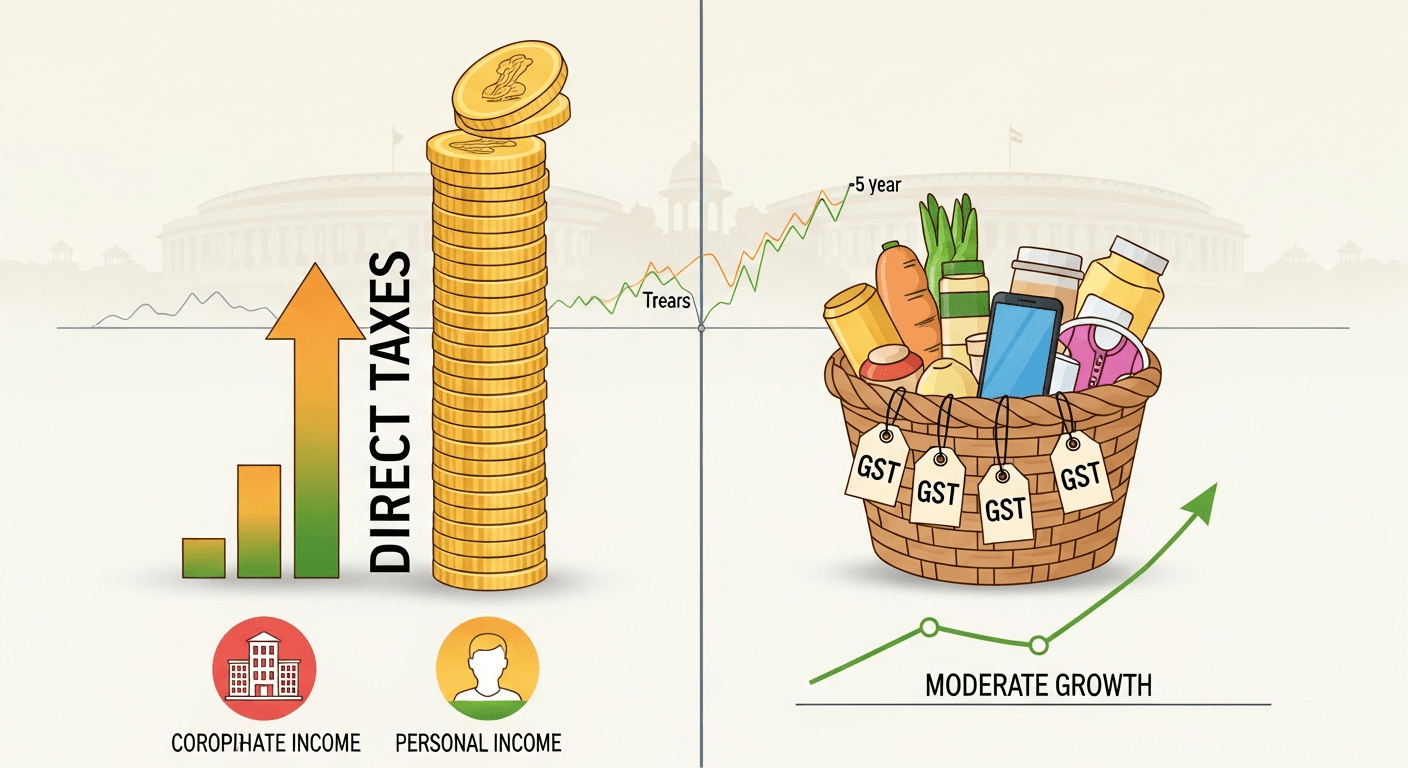

1) Direct taxes are becoming the stronger growth engine

- Direct tax collections have risen faster than indirect taxes over this window. That reflects rising corporate profits, improved reporting of personal incomes, and policy steps (simplifications, compliance drives) that boost yield from incomes and profits.

- Practically, that means the Centre is getting a more elastic revenue source — one that tends to grow with formal-sector incomes and corporate profitability. The RBI and other analysts have noted that tax revenue as a share of GDP is headed higher in FY26.[3]

2) Indirect taxes still matter — and they behave differently

- Indirect taxes (GST + customs + excise) have grown steadily as consumption recovered and GST administration improved. But their growth has been less steep than direct taxes in recent years.

- Indirect taxes are broadly regressive by design: a rupee of GST hits all consumers, but it takes a larger share of income from lower-income households. That makes the mix of direct vs indirect receipts a core equity question.

3) Buoyancy, composition and fiscal strategy are linked

A fiscal strategy that leans more on direct taxes is consistent with progressive redistribution and greater built‑in buoyancy during growth spells. But it requires credible enforcement, predictable rules, and simplicity to avoid litigation and avoidance.

Relying more on indirect taxes can be quicker to administer (especially through GST) but risks political and distributional pushback — particularly if inflation or essential‑goods taxation spikes.

4) Policy changes matter as much as macro cycles

- The past five years saw significant tax administration reforms (faceless processes, better data matching, GST law tweaks) and structural policy moves that affect collection dynamics. Those reforms often raise compliance and therefore collections without always changing headline tax rates.

- Simplification efforts — including the proposed new income‑tax rewrite and tweaks to GST rules introduced over the last year — have been part of the backdrop to these collection trends.[2][4]

5) The distribution question: who bears the burden?

Direct taxes are progressive and give the government a redistributive lever. As direct taxes grow faster, there is potential to strengthen targeted social spending without raising regressive levies.

But the reality is also that a small share of taxpayers account for a large share of direct tax revenue. Expanding the taxpayer base sustainably and fairly remains a long‑term challenge (and one I have written about previously).[5]

Why this matters for Budget 2026

- Fiscal space and priorities: The mix of tax receipts influences how much room there is for capital spending, subsidies, and targeted welfare. With FY26 projections showing an improving tax‑to‑GDP ratio, the authorities can either accelerate capex or use some headroom to ease consumption‑side burdens.

- Equity vs efficiency tradeoffs: Choices between cutting personal tax rates, changing GST coverage, or offering targeted relief will depend on whether the government wants to nudge consumption, help middle‑income families, or shore up long‑term redistributive tax capacity.

- Inflation and incidence: If indirect taxes rise or if GST mixes shift, the immediate effect is on prices and household budgets. Direct tax changes take longer to translate into consumption responses.

Practical takeaways for citizens, business and policy watchers (my reflections)

For taxpayers: expect continued emphasis on compliance and simplification. If direct taxes remain the growth story, filing transparency and correct reporting will matter more — not just because of enforcement but because the policy conversation is moving toward fairness and simplification.

For businesses: corporate profitability drives direct tax flows. Stable, predictable corporate tax rules and lower litigation are wins for investment and for the revenue base that funds public goods.

For policy: the ideal is a balanced tax mix — progressive direct taxes to protect equity and robust indirect taxes (with smart exemptions and compensation for the poor) to finance infrastructure and services.

Where I’ve written about similar themes

I have argued earlier — sometimes provocatively — about the shape and ambitions of our tax system and its relation to consumption and growth.[5] Those pieces explored stronger moves toward tax simplification and even radical options to alter the incentives in the economy. That long‑run conversation matters because the present five‑year data are not just cyclical; they are shaped by design choices.

Questions Budget 2026 should answer (for me)

- Will the government anchor its revenue strategy around continued growth in direct taxes via simplification, or will it shift toward consumption measures to keep prices and inflation management simple?

- How will Budget 2026 protect low‑income households if indirect taxes are adjusted for revenue reasons?

- Will reforms to tax law and dispute resolution continue to lower litigation and increase voluntary compliance?

Conclusion — a modest, personal take

The five‑year numbers are encouraging: India is collecting more from incomes and consumption alike. That gives policymakers options. My preference is clear: use the room provided by rising direct tax receipts to make the system fairer and simpler, protect the vulnerable from regressive incidence, and invest boldly in public goods that expand productive capacity. The numbers are not destiny — they are evidence. How we interpret and act on them in Budget 2026 will matter for growth, equity and public trust.

References

[1] Times of India, "Budget 2026: What five years of data reveal…" — a concise explainer of the FY21–FY26 direct/indirect figures and trends. (See: https://timesofindia.indiatimes.com/business/india-business/budget-2026-what-five-years-of-data-reveal-about-indias-direct-and-indirect-taxes-explained/articleshow/127822563.cms)

[2] Budget at a Glance (Union Budget documents) — official tables and central receipts/estimates. (See: https://www.indiabudget.gov.in/doc/BudgetatGlance/budgetata_glance.pdf)

[3] RBI and fiscal commentary on tax revenue share and buoyancy (analysis and press summaries during FY25–26 reporting).

[4] Industry and advisory notes on Budget 2025–26 tax proposals and law simplification (KPMG/PwC summaries and sector commentary).

[5] My earlier reflections on the shape of India’s personal income tax and tax reform possibilities, including proposals and thought experiments I have published in past posts (see: https://myblogepage.blogspot.com/2017/12/budget-time-is-taxing-time.html and https://myblogepage.blogspot.com/2024/12/how-about-abolishing.html).

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment