Why this deal matters — and why it upset Washington

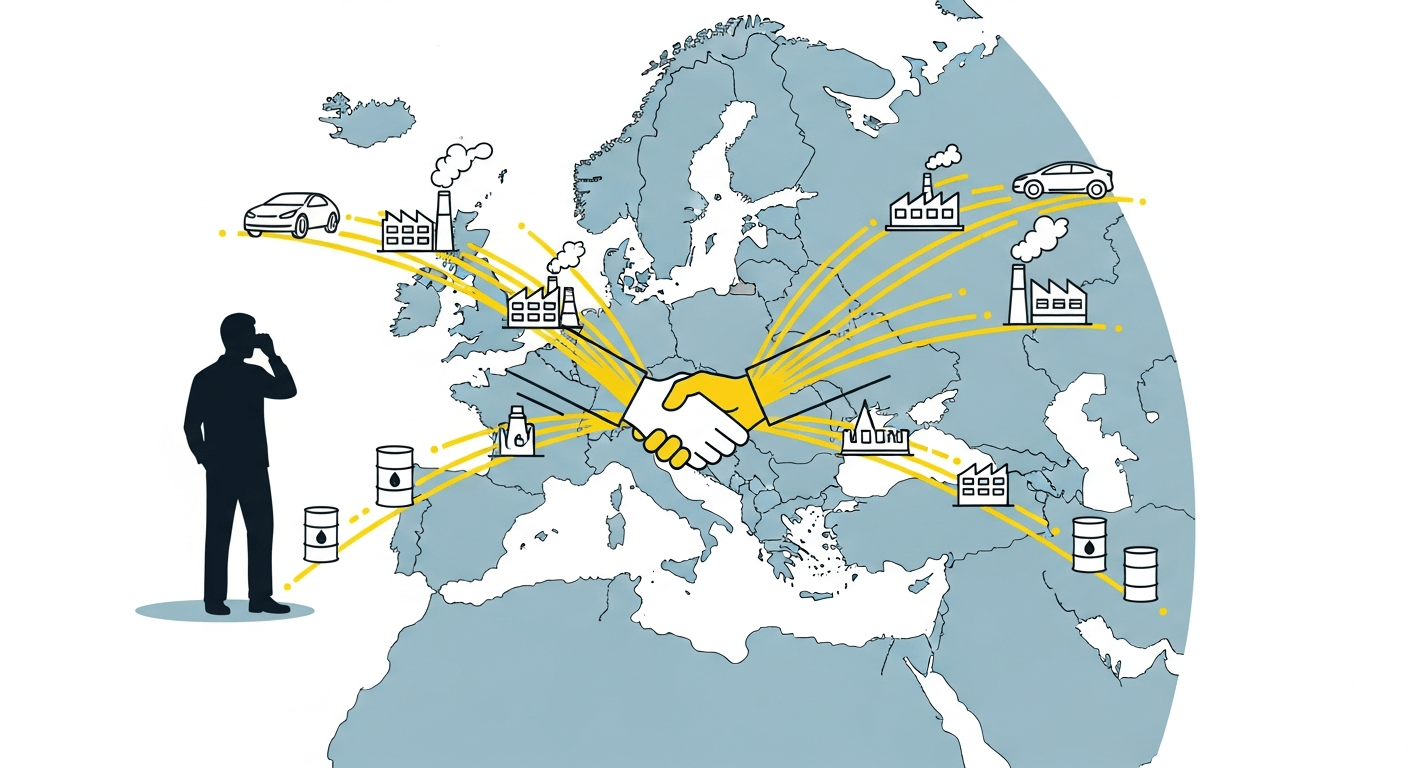

I write from the perspective of someone who has tracked trade, technology and geopolitics for years: big trade pacts rarely stay only about tariffs. The India–EU free trade agreement — already hailed in Brussels as the "mother of all trade deals" — is a case in point. It is a commercial pact that will reshape markets, supply chains and strategic calculations. And it has provoked a sharp response from Washington.

Quick background: the long road to a big pact

Negotiations between India and the European Union began nearly two decades ago and were paused more than once. They restarted with fresh urgency in recent years as both sides sought to diversify markets and de-risk supply chains in a more fractious global environment. The package under discussion is unusually broad: lower tariffs on a range of goods, commitments on services and investment, new regulatory cooperation on digital and sustainability standards, and mechanisms to encourage industrial and tech partnerships.

It is being called the "mother of all trade deals" for a reason: together the EU and India represent nearly two billion people and roughly a quarter of world GDP. For European firms looking for growth outside a slowing China, and for Indian industry aiming to scale into high-value manufacturing and services, the deal offers a first-mover opportunity.

The US objection, in plain terms

A senior US Treasury official captured Washington’s ire bluntly in recent interviews, warning that Europe risks "financing the war against themselves" by moving so quickly to lock in commercial ties with India. The thrust of the US concern is twofold:

- Energy and sanctions leakage: the official argued that oil shipments from sanctioned producers can be processed in third countries and re-exported as refined products, enabling the original producer to keep earning revenue despite direct sanctions. In the official’s formulation: crude goes into one country, refined products come out, and buyers elsewhere effectively keep paying the original producer.

- Alliance coherence: the US sees its own tariff and sanctions posture (including punitive levies aimed at influencing energy flows) as part of a broader strategy to pressure an aggressor state. Washington worries that major partners pursuing independent commercial deals will blunt the leverage those measures were intended to create.

Put simply: the US worries that a large trade pact that does not squarely address energy and sanction spillovers could undermine the political toolkit used to respond to conflicts.

Why many in Europe and India see things differently

European institutions frame the agreement as part of a strategic pivot to "de-risk" — not decouple — from single-source suppliers, and to secure access to manufacturing and critical technologies. For the EU, deeper economic ties with India can:

- Open a major, growing market for European industry (autos, green tech, machinery);

- Anchor regulatory standards globally (the so-called "Brussels effect");

- Provide alternative suppliers for critical inputs and clean-tech value chains.

India, for its part, stands to gain technology transfers, investment in manufacturing, better market access for services and pharmaceuticals, and an implicit political signal of trust from 27 European economies.

Both sides argue that the deal is about jobs, standards and industrial resilience — not geopolitics alone.

What this means for trade, defense and supply chains

Trade flows: expect immediate reorientation in sectors that benefit from reduced tariffs (certain auto segments, machinery, chemicals, and services). European firms could localize more production in India to serve both markets.

Supply chains: the pact will accelerate efforts to diversify away from single-source dependencies. That could help Europe and India reduce reliance on particular foreign suppliers for batteries, solar inputs, pharma intermediates and electronics components.

Defense & security supply chains: while the FTA is not a security pact, stronger industrial ties can alter defense supply relationships over time — from sourcing of dual-use components to joint R&D in critical technologies. That raises questions about export controls, technology transfer protections and interoperability.

Sanctions and energy: the US concern about refined-product flows is real in technical terms. Addressing it requires cooperation on customs rules, tracing supply chains and perhaps common rules on energy trade — but such measures are politically sensitive, especially for countries prioritizing energy security and commercial ties.

Reactions and commentary (institutional and analytical)

European institutions emphasize strategic autonomy and the economic scale of the partnership; they have framed the pact as part of a larger push to secure Europe’s industrial future.

The Indian government has presented the deal as a win for growth and diversification, insisting on negotiation autonomy and protection of sensitive domestic interests.

The US has publicly signalled displeasure through senior officials and through trade measures imposed earlier. Washington’s posture mixes substantive worries about sanctions circumvention with broader concerns about allied cohesion.

Analysts are split. Some see the deal as a natural rebalancing in a multipolar world — a pragmatic choice for both Europe and India. Others warn that without coordinated approaches to energy and financial flows, trade liberalization could produce unintended strategic frictions.

Potential scenarios going forward

Managed cooperation: Europe, India and the US open a trilateral dialogue to agree practical measures on energy tracing, customs cooperation and export controls. The pact proceeds, but with side arrangements that limit sanction leakage.

Competitive fragmentation: the deal deepens a multipolar trade architecture. The US responds with persistent tariffs and transactional diplomacy; Europe deepens commercial ties with India while keeping strategic alignment on other fronts.

Conditional carve-outs: Brussels negotiates safeguards or clauses in the pact that allow it to act on specific security or sanction-related risks, balancing trade liberalization with political constraints.

Escalation and tit-for-tat: worst-case, sustained policy divergence prompts retaliatory measures, slower commerce, and uncertainty for multinational investment decisions. That outcome would be bad for global growth.

Where I have been before on this theme

I have written before about how rising trade frictions and the erosion of multilateral predictability push countries toward bilateral and regional arrangements as a way of hedging risk and securing markets A TradeWar Epidemic?. This EU–India moment is exactly the kind of reordering I warned about: trade deals are now instruments of strategic positioning as much as economic liberalization.

Conclusion — the practical takeaway

This agreement is more than a commercial ledger. It is a structural nudge toward a multipolar trade order: big markets choosing pragmatic partnerships to lock in supply, standards and investment. That will benefit firms and consumers who gain access and choice — but it also creates a new set of geopolitical trade-offs. The smartest path will be pragmatic coordination: use the deal to reinforce supply chains and common standards, while building narrow, technical cooperation to prevent trade from becoming a vector for conflict financing. Without that, the frictionary politics we see today could become the structural politics of tomorrow.

Sources and places to read further: Reuters, Financial Times, Bloomberg, The Hindu, NDTV, Moneycontrol and Hindustan Times.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment