I keep rereading the claim and asking myself: is this a technological prophecy or an optimistic forecast stretched by enthusiasm? When Sam Altman (sama@openai.com) says the cost to use a given level of AI is falling roughly 10x every year and that the price of many goods will "eventually fall dramatically," he's sketching a world with far cheaper knowledge work and, by extension, many cheaper goods and services. I want to walk through what that could mean in concrete terms — and where the fog of reality limits the view.

What Altman actually said

Sam Altman (sama@openai.com) has repeatedly argued that units of "intelligence" are getting dramatically cheaper — Business Insider and other outlets cite his observation that token costs dropped roughly ~150x between early 2023 and mid‑2024, and he frames a ~10x annual decline as plausible for the near term Business Insider. That’s the core of the deflation thesis: cheaper compute + better models = lower cost of producing services that are intelligence‑heavy.

How AI could cut costs — tangible examples

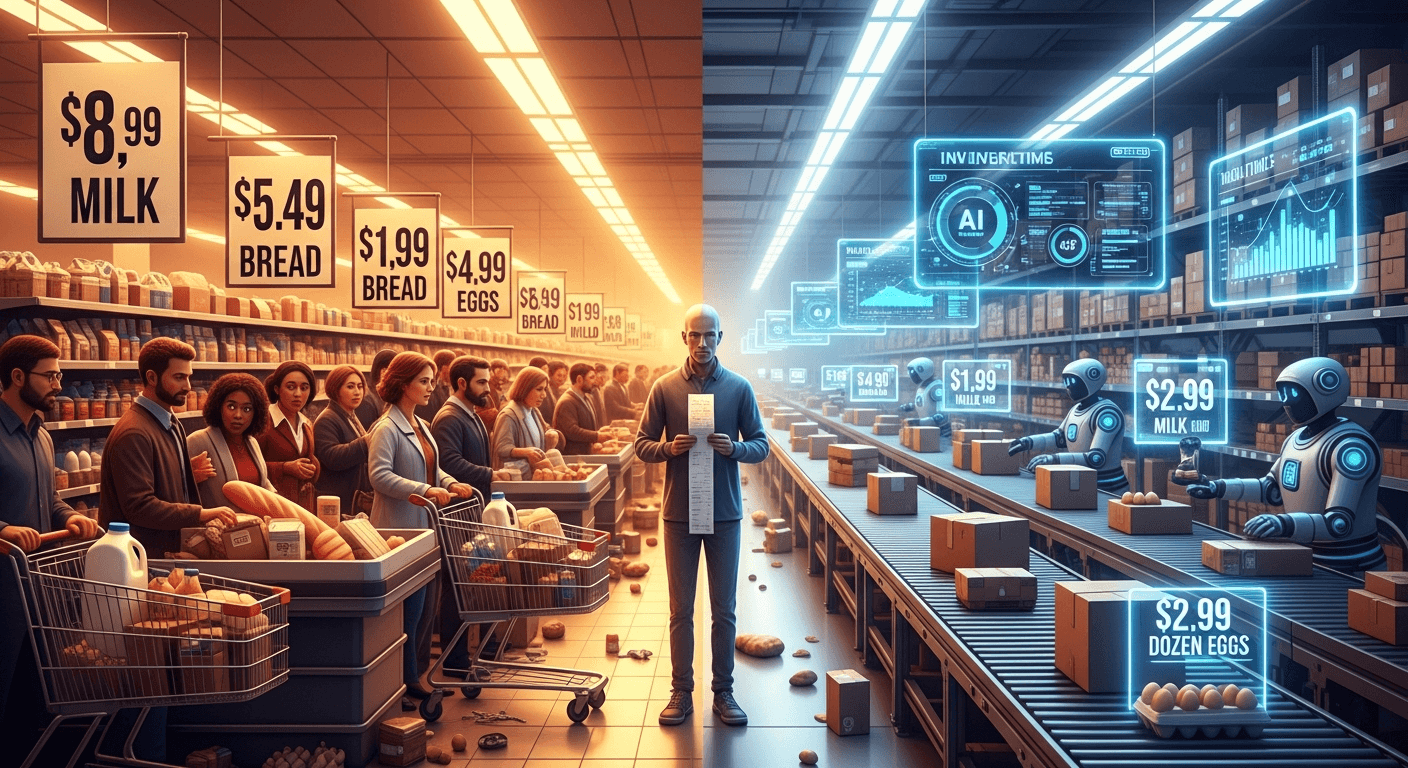

Groceries: AI-driven forecasting, automated warehouses, and optimized routing can reduce spoilage, lower logistics costs, and tighten inventories. Illustrative effect: automation and better demand prediction could shave perhaps 5–15% off distribution costs over 3–7 years in leading markets.

Utilities (energy, water): AI improves grid balancing, demand response, and predictive maintenance. When paired with cheaper renewables and storage, system-level costs per kWh can fall; early adopters might see 5–20% savings in operational expense over a decade.

Housing (construction & maintenance): AI plus robotics and modular prefabrication can speed builds and cut labor costs. But land is fixed — so AI can reduce construction and transaction costs (maybe 10–30% on building cost in favorable scenarios) but not eliminate rent pressures in tight cities.

Healthcare: AI-assisted diagnostics, triage bots, and automated admin can lower per‑visit costs and speed throughput. For non‑surgical, knowledge‑work heavy services, 20–50% cost declines in specific workflows are plausible within 5–10 years — but clinical validation, liability, and reimbursement policies slow widespread savings.

Transport: Routing, fleet automation and predictive maintenance lower fuel and labor costs. For logistics operators, AI efficiencies can cut operating costs by double digits; full consumer price effects depend on competition and regulation.

Services (legal, education, design): Knowledge work is the low‑hanging fruit. AI copilots can allow a single expert to do work formerly requiring teams. Expect large price squeezes here — in some niches prices could fall 50%+ in a few years as new delivery models emerge.

These numbers are illustrative — they depend on adoption, regulation, and how fast the cost of compute and models fall in practice.

The economic mechanisms at work

- Automation: Replacing routine tasks with software/agents reduces labor hours per unit of output.

- Improved supply chains: Better forecasting and dynamic pricing reduce waste and inventory costs.

- Price competition: Lower marginal costs invite disruptive entrants and new business models that undercut incumbents.

- Productivity gains: More output per worker lowers unit costs and can be passed to consumers if markets are competitive.

Altman’s thesis is essentially a claim that these mechanisms will operate at enormous scale as the cost of intelligence collapses.

Realistic timelines and magnitudes

We should be cautious. For purely digital tasks (software, writing, search), meaningful price declines are already visible and could accelerate over 1–5 years. For physical goods and labor‑intensive services (construction, full nursing care, complex surgery), expect much longer timelines — 5–20+ years — because robotics, regulation, and safety are tougher barriers.

Magnitude: some services may see 30–70% price drops in the next decade; broad consumer staples (groceries, utilities) might see 5–20% shifts depending on market structure and energy prices. Housing supply costs could fall in places with modular construction adoption, but land scarcity and zoning limit the consumer impact.

Counterarguments & risks

- Job displacement: Rapid automation can create transitional unemployment and regional pain. Gains may concentrate in owners of capital and skills, not broadly distributed.

- Market concentration: If a few cloud/AI platforms control core models and compute, they can capture surplus and blunt consumer price benefits.

- Regulatory limits: Safety, liability, licensing (healthcare, legal) slow adoption; some use cases will face long regulatory trails.

- Rebound effects and hidden costs: Lower prices can increase consumption (more deliveries, more compute), offsetting savings; privacy, security, and audit costs also rise.

The role of policy and regulation

If society wants AI-driven savings to be broad and fair, policy matters:

- Universal safety nets (unemployment insurance, wage insurance) to smooth transitions.

- Real‑money retraining programs and portable benefits to help displaced workers move into higher‑value roles.

- Antitrust and open‑model policies to prevent monopolistic capture of AI rents.

- Transparency and audit rules for high‑impact models (health, finance) so cost savings don’t come at the expense of safety.

I’ve argued before that low manpower costs and structural policy choices shape price dynamics; see my longer take on building a low‑cost economy and the risks/rewards of wage and cost policy My blog on wage/price dynamics. That continuity matters: technology changes possibilities, policy decides distribution.

Practical steps today — for consumers and businesses

- Consumers: Learn to use AI tools to reduce time and cost (price comparison agents, cooking planners to reduce waste). Be cautious: cheap services can hide lower quality.

- Businesses: Pilot AI to cut operational waste (supply chain forecasting, customer support automation), measure real ROI, and reskill staff into supervision/strategy roles.

- Policymakers & communities: Invest in reskilling, adapt unemployment supports, and incentivize open infrastructure that spreads benefits.

Balanced conclusion

I share the optimism that AI has real deflationary potential in many domains — especially knowledge work and logistics. But history reminds us that technology alone doesn't guarantee cheaper everyday life for everyone. Distributional dynamics, regulation, physical constraints (like land), and corporate responses will decide whether gains become widely shared price relief or concentrated profit.

So yes — AI can and likely will push costs down in many areas. But the magnitude and universality of those savings depend on choices we make now: policy design, competition law, and investment in people. I remain hopeful, but my hope is active: we must build institutions that steer AI's deflationary power toward broad, durable benefit.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment