Intro — Executive summary

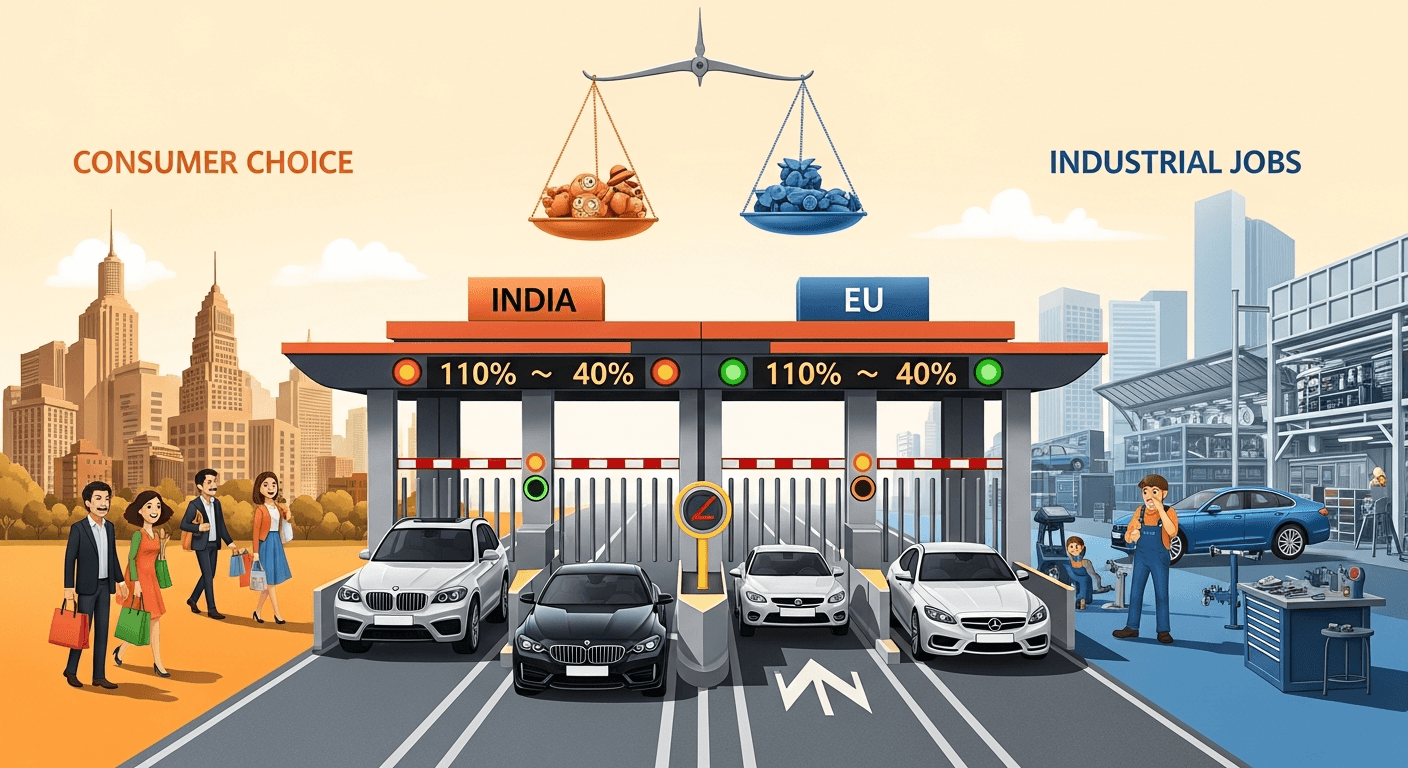

I write this as someone who watches trade policy closely and worries about its human and industrial consequences. Recent reports indicate New Delhi is prepared to cut import duties on certain cars from the European Union from current levels (between roughly 70% and 110% depending on price bands) to about 40% immediately for a limited annual quota, with gradual cuts to as low as 10% over time. The move—part of an anticipated India–EU free trade agreement—would be the largest opening of India’s historically protected passenger vehicle market. The package reportedly includes a quota of around 200,000 combustion-engine vehicles a year, an import price floor (about €15,000), and a temporary exclusion of battery electric vehicles (EVs) from duty cuts for roughly five years.

Background: where these negotiations come from

Talks between India and the EU have been long-running and politically charged. Both sides have economic incentives: the EU seeks greater market access for high-value manufactured goods and services; India seeks better export access for textiles, jewellery, services and diversification of supply chains. For nearly two decades the conversations have balanced tariff liberalisation against domestic sensitivities—especially in sectors like automobiles where local manufacturing, component ecosystems, and jobs are at stake.

India’s pre-existing tariff structure on fully built-up (CBU) imported cars has been among the world’s highest: tariffs commonly quoted in reporting range from about 70% for lower-price CBUs to 110% for high-priced luxury models. Those levels have discouraged broad imports and protected local assembly and component suppliers.

The proposed tariff cut: specifics and why it matters

According to reporting, the immediate step would be to cut applicable import duties to around 40% for a constrained volume (circa 200,000 combustion-engine cars annually) and for units above a minimum import price (~€15,000). Over subsequent years these duties could be reduced further—potentially to around 10%—as part of a phased schedule.

Why this is significant:

- Scale: a move from up to 110% to 40% is a dramatic erosion of protection, compressing the price wedge between imported and domestically produced vehicles.

- Targeting: the quota and price floor aim to focus market opening on premium and higher-priced models rather than low-cost mass-market cars.

- Phasing on EVs: excluding EVs for an initial period signals intent to shield a nascent domestic EV manufacturing base while liberalising conventional car imports.

Potential benefits: consumers and European automakers

For Indian consumers

- Lower effective prices for imported premium models: a lower duty can translate into meaningful price drops for luxury and niche models, improving choice among affluent buyers.

- Faster access to new technology and variants: imports let buyers experience cutting-edge features (safety, infotainment, drivetrains) without waiting for local production ramps.

For EU automakers

- Easier market entry and testing: the quota lets manufacturers test demand for new models before heavy local investment.

- Commercial rationale for incremental investment: predictable tariff schedules encourage firms to plan phased localization and R&D investments in engineering and software.

Contextual figures: India’s passenger vehicle market recently stood at about 4.4 million units annually, with projections to reach roughly 6 million by 2030. European brands currently account for a small single-digit share of the market—reports place it under 4%—so even a modest inflow could change the high-end segment dynamics.

Concerns: domestic industry and labour

My main unease is twofold.

Industrial impact

- Component suppliers and domestic assemblers could face headwinds if imports scale beyond the quota. The Indian auto ecosystem employs millions across OEMs and tiered suppliers; sudden demand shifts could disrupt investment plans.

- Localisation plans: foreign firms may prefer easier imports at lower duty rather than immediate large-scale localisation, delaying technology transfers that local suppliers need.

Labour and social effects

- Job displacement risk exists in assembly and component plants if demand shifts away from locally made models. Even if total employment effects are muted, regional shocks can be concentrated.

- Re-skilling and adjustment policies will be essential—both to help workers move into higher-value segments (software, EV components, battery manufacturing) and to support geographic transitions.

Policy design matters: quota size, rules of origin, transition schedules, and safeguards will determine whether the opening becomes an opportunity or a shock.

Broader economic and political implications

Economically, the agreement could deepen India–EU trade ties, boost bilateral goods and services flows, and help Indian exporters find offsetting markets amid global tariff volatility. Politically, an FTA that includes a visible concession on a high-profile sector like autos signals willingness to liberalise—potentially catalysing other reforms.

At the same time, any FTA must balance trade gains against public and political acceptability. Domestic constituencies—manufacturing states, labour unions, and component makers—will watch the details closely. The decision to keep EVs out of the initial carve-out reflects a deliberate political economy choice to protect a strategic sector while liberalising others.

Timelines and negotiation dynamics

Reports suggest the announcement could be near-term, with phased implementation. But these negotiations are typically punctuated by last-minute adjustments. Key dynamics to watch:

- Quota sizing and adjustment rules (will the 200,000 figure be final?)

- Price thresholds and product definitions

- Treatment of EVs and local value-add requirements

- Safeguard or sunset clauses in case of disruptive import surges

The credible path to lower duties over time is as important as the headline cut: predictable, phased liberalisation gives industry time to adapt and invest.

Conclusion — balanced takeaways

This proposed tariff shift is a moment of opportunity and risk. If designed carefully—with sensible quotas, clear localisation incentives, worker re-skilling programs, and targeted safeguards—it can widen consumer choice, attract high-value investment, and strengthen long-term bilateral ties. If managed poorly, it could create localized disruption in manufacturing and employment and slow the development of domestic value chains.

As an observer, I believe the right calibration is a phased, transparent schedule coupled with active industrial policy: encourage EU firms to localise higher-value activities (engineering, battery cell assembly, software), support component suppliers to upgrade, and provide social buffers for workers. Trade liberalisation need not be a binary choice between protection and free trade; with disciplined negotiation and policy design, it can be an engine for modernization.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment