Why this moment matters

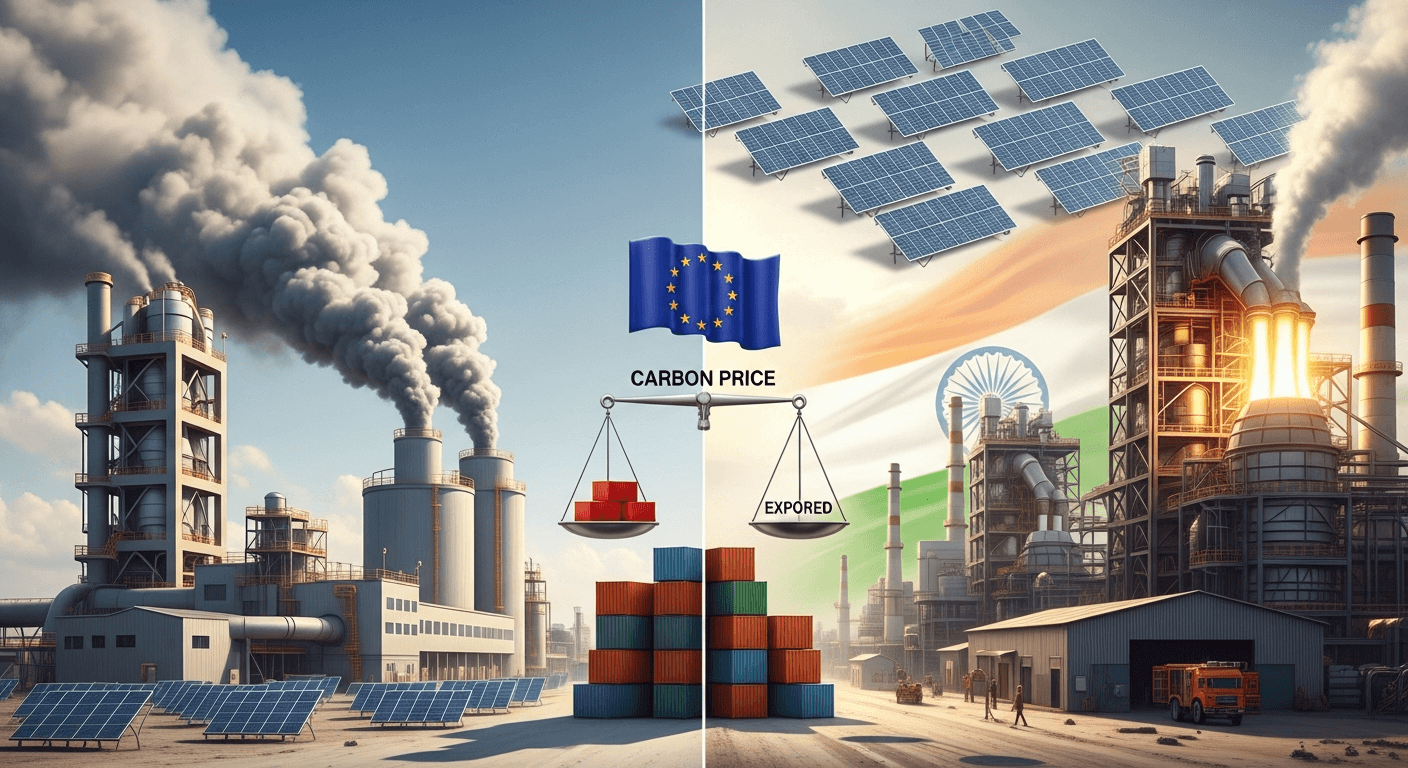

India is waking up to a practical truth: climate policy is now trade policy. The European Union’s Carbon Border Adjustment Mechanism (CBAM) will price the carbon embedded in imports of cement, aluminium, steel and other hard-to-abate goods. If exporters cannot show low, verified emissions at the plant level, their goods will carry an extra cost — and customers will ask for discounts or look elsewhere.

Last week NITI Aayog released roadmaps for deep decarbonisation in the cement and aluminium sectors — a move that can make this crisis a strategic opportunity for India rather than a lasting handicap Times of India.

What the roadmaps aim to do — and why they matter

The NITI Aayog blueprints point to practical, staged interventions:

- Cement: reduce clinker intensity (substitution), scale refuse-derived fuels and alternative fuels, invest in energy efficiency, and plan for Carbon Capture, Utilisation and Storage (CCUS).

- Aluminium: move toward renewable energy round-the-clock (RE-RTC), strengthen grid connectivity, explore low-carbon feedstocks and integrate CCUS over time.

Taken together, these measures lower the "tonnes CO2 per tonne product" that CBAM will use to calculate import costs. For exporters to the EU, lower plant-level intensity translates directly into price advantage or simply the ability to keep selling into that market.

The two simultaneous challenges: technology and verification

There are two walls to climb:

- Technology and investment: many large producers (and a few forward-looking mid-sized firms) can invest in cleaner routes — clinker substitution, EAFs or green power contracts — but MSMEs and older plants will struggle without targeted policy and financing.

- Measurement, Reporting & Verification (MRV): CBAM is a factory-level accounting regime. Without reliable plant-level emissions data and accredited verifiers, exporters risk being assigned punitive default values.

The policy work done so far — including the draft Carbon Credit Trading Scheme and India’s push to develop MRV and verification capacity — is exactly the right direction. I’ve argued previously that India must build robust carbon accounting institutions and a credible certificate-issuing agency to win international recognition and to shield our exporters (see my earlier notes on computing carbon credits and CBAM preparation). For background reading I have discussed these themes in earlier posts, for example: How to Compute Carbon Credits? and Can We Rise to EU Challenge? (examples of my past pieces).

What India should do next — practical recommendations

Policy-makers and industry need to move in parallel. My practical checklist:

- Fast-track MRV capacity: build accredited verifiers, plant-level reporting templates and a public registry of verified footprints so exporters can avoid default CBAM values.

- Support MSMEs: a targeted financing window (cheap loans, partial capital grants) to retrofit energy efficiency and replace worst-in-class equipment.

- Incentivise low-carbon fuel and material substitution: scaled incentives for clinker substitution, increased use of industrial waste fuels, and policy nudges for circular-material inputs and scrap in aluminium value chains.

- Back CCUS pilots: use large, export-oriented clusters (cement hubs, alumina/aluminium complexes) as CCUS demonstration zones with shared infrastructure.

- Align domestic carbon pricing with trade reality: adopt a clear pathway for carbon pricing or a credible carbon-credit trading mechanism that the EU could recognise as partial CBAM relief.

- Diplomatic engagement: seek technical recognition from the EU for India’s verification and trading systems (this reduces double-pricing and secures market access during the transition).

Evidence and analysis from Indian think-tanks and industry studies show this combination of supply-side investments and MRV capacity is the most cost-effective way to preserve export competitiveness while accelerating India’s own net-zero pathway.CSEP working paper on CBAM and India provides a good policy synthesis.

A caution and an opportunity

CBAM will not affect all firms equally. Large, integrated producers who can electrify, switch fuels, or access green power will adapt faster. Smaller units risk being squeezed. Without careful policy design, we risk creating an uneven transition that damages livelihoods and competitiveness.

But there is an upside: decarbonisation investments improve productivity, reduce energy import dependence, and open markets that value low-carbon inputs. If India levers this moment well, the country can transform parts of its heavy industry into global low-carbon supply chains rather than ceding them to competitors.

My closing, practical thought

The EU’s carbon border tax is a wake-up call, not merely a tariff. The NITI Aayog roadmaps are timely — they convert a regulatory shock into a strategic industrial upgrade program. The work ahead is implementation at scale: MRV systems, financing for upgrades, CCUS pilots, and credible domestic carbon instruments that the world can trust. Those who build the verification, financing and technology bridges will keep the customers; those who do not will find markets closing.

If we act decisively, decarbonisation becomes not a cost of compliance but an investment in competitiveness.

Selected sources and further reading:

- "India's move to decarbonise cement, aluminium sectors may help it navigate the EU's carbon border tax in due course," Times of India: https://timesofindia.indiatimes.com/business/india-business/indias-move-to-decarbonise-cement-aluminium-sectors-may-help-it-navigate-the-eus-carbon-border-tax-in-due-course/articleshow/127596539.cms

- Centre for Social and Economic Progress, working paper on India and CBAM: https://csep.org/working-paper/indias-carbon-border-adjustment-mechanism-cbam-challenge-strategic-response-and-policy-options/

- My earlier discussion of carbon accounting and readiness: http://mylinkedinposting.blogspot.com/2024/10/how-to-compute-carbon-credits.html

Regards,

Hemen Parekh — hcp@recruitguru.com

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment