PM SVANidhi Credit Card

Intro

I’ve written this as a practical, vendor-first guide to the new PM SVANidhi Credit Card — what it is, who gets it, what benefits to expect (rewards and cashback), and exactly how to apply. I keep things short and actionable so a busy vendor can read, decide, and apply without getting lost in jargon.

Why it matters (short)

For many vendors, access to affordable, formal credit and easy digital payments makes the difference between missed sales and steady growth. The PM SVANidhi Credit Card is designed to:

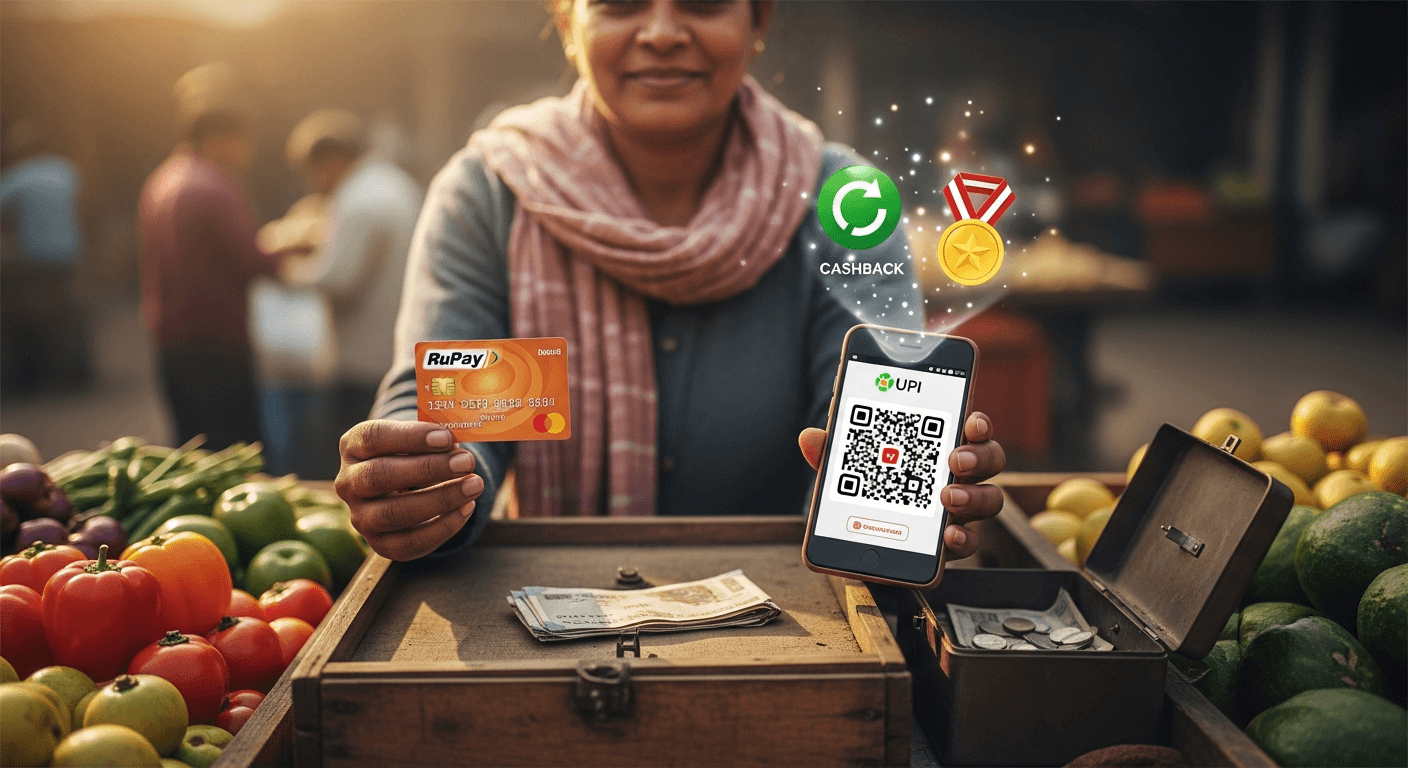

- Give instant, small-ticket credit (UPI-linked RuPay card) for daily needs,

- Reward digital receipts with cashback and points, and

- Build a formal credit history for bigger loans later.

Eligibility (simple checklist)

You can apply if you meet the PM SVANidhi scheme eligibility and the credit-card specific conditions below:

- You are a registered street vendor under the PM SVANidhi scheme (CoV/ULB record or LoR).

- You have repaid the second tranche of your PM SVANidhi loan on time (i.e., eligible for 3rd tranche) — this is the common requirement for the credit card.

- Age typically 21–65.

- Not a defaulter on any active bank loan/credit card.

For the primary scheme rules and registration details see the official PM SVANidhi Portal: PM SVANidhi Portal.

Card features (limits, rewards, cashback, restrictions)

- Card type: UPI-linked RuPay Credit Card (domestic).

- Starting credit limit: usually ₹10,000; can increase up to ₹30,000 with good repayment and scheme progression.

- Validity: often issued for 5 years (check your bank’s T&Cs).

- Reward points: typical offering is 1 reward point per ₹100 spent on eligible transactions (bank product pages show this structure).

- Cashback: digital sales cashback up to ₹100 per month (₹1,200/year) for UPI/QR transactions in many implementations; additional wholesale purchase cashback schemes (e.g., quarterly caps like ₹400) apply in some banks.

- Interest-free period: cards generally offer interest-free days (20–50 days) if you clear the statement on time.

- Other features: lifetime-free variants (no annual fee) are available from some partner issuers, EMI conversion options for purchases above a threshold, and contactless payments.

- Restrictions: the card is for PM SVANidhi beneficiaries who meet tranche-repayment criteria; terms (limits, reward rates, cashback caps, fees) can vary by issuing bank — read the bank’s product page before applying.

Sources describing these standard features include recent scheme coverage and bank product pages (examples: BOBCARD product page and scheme summaries reported by financial outlets such as Upstox and Angel One summary).

Estimated cashback / rewards — a quick example you can run in your head

Assumptions (typical published limits): cashback ₹100/month on digital receipts; reward points 1 point per ₹100; redemption value varies by issuer (example: some issuers value 1 point ≈ ₹0.20).

- If you take digital payments and qualify for the full ₹100/month cashback, that’s ₹1,200/year.

- If you use the credit card for business purchases of ₹10,000 in a month:

- Reward points = 10,000 / 100 = 100 points → if 1 point = ₹0.20, value = ₹20.

So, monthly digital cashback (₹100) is likely to be much more valuable to a small vendor than reward points alone. Use the card to capture digital receipts first (to earn cashback) and use rewards as a secondary benefit.

Step-by-step: How to apply (practical)

- Be sure you meet eligibility (see checklist above).

- Prepare documents: Aadhaar (linked to mobile), PAN (if required by the bank), PM SVANidhi beneficiary ID / Certificate of Vending (CoV) or LoR from ULB, bank passbook, and active UPI ID.

- Log in to the PM SVANidhi Portal or mobile app with your registered mobile number and SRN (Survey Reference Number) / vendor details: PM SVANidhi Portal.

- On the portal/app, choose “Apply for Credit Card” (or similar). Submit the request — you will typically receive an SMS/email with a link to the issuing bank.

- Complete the bank’s online form (e-sign/Aadhaar-based e-KYC) and Video KYC if required by the bank. Upload requested documents and verify details.

- Bank processes the application; once approved, card will be issued (some banks provide instant virtual number or UPI linkage so you can use funds quickly).

Notes: many partner banks give an in-app or SMS link to complete the bank’s process. If you prefer help, visit your issuing bank branch, your nearest Common Service Centre (CSC), or your ULB office.

Where to apply / who issues the card

- Apply via the official PM SVANidhi Portal or mobile app: PM SVANidhi Portal.

- The actual credit card is issued by partner banks (examples of partner product pages and coverage include Bank of Baroda BOBCARD and other PSU/private banks). Check the PM SVANidhi portal after you request the card — it will direct you to the issuing bank you’re assigned or can choose. See a product example: PM SVANidhi BOBCARD and scheme press coverage: Upstox summary.

Practical tips for vendors (what I would do)

- Link Aadhaar to your mobile and keep PAN and bank passbook handy before starting the application.

- Use digital receipts (QR/UPI) for sales to capture monthly cashback — it’s the simplest immediate gain.

- Use the card for business purchases and repay within the interest-free period to avoid interest.

- Keep monthly statements and payment receipts — it builds a clean record and helps qualify for higher limits.

- If you need a larger purchase (>₹2,500), see if the issuer offers EMI conversion to spread cost.

- Treat the card like working capital: use only as much as needed and avoid revolving balances that attract interest.

Where I checked facts (links I used while writing)

- Official PM SVANidhi Portal (scheme details and application): PM SVANidhi Portal

- Bank product page example — PM SVANidhi BOBCARD: BOBCARD PM SVANidhi product page

- Recent scheme summaries and reporting: Upstox article summarising eligibility and benefits, Angel One coverage

- Related explanatory videos and regional coverage (useful if you prefer step-by-step visual walkthroughs).

Final note

If you’re already in the PM SVANidhi program and have repaid prior tranches on time, this credit card is designed to be a simple next step — immediate small-ticket credit, digital receipts cashback, and a path to build credit. Read the issuing bank’s terms before accepting the card, and prioritise timely repayment to keep costs down and limits rising.

Regards, Hemen Parekh (hcp@recruitguru.com)

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment