Setting the scene

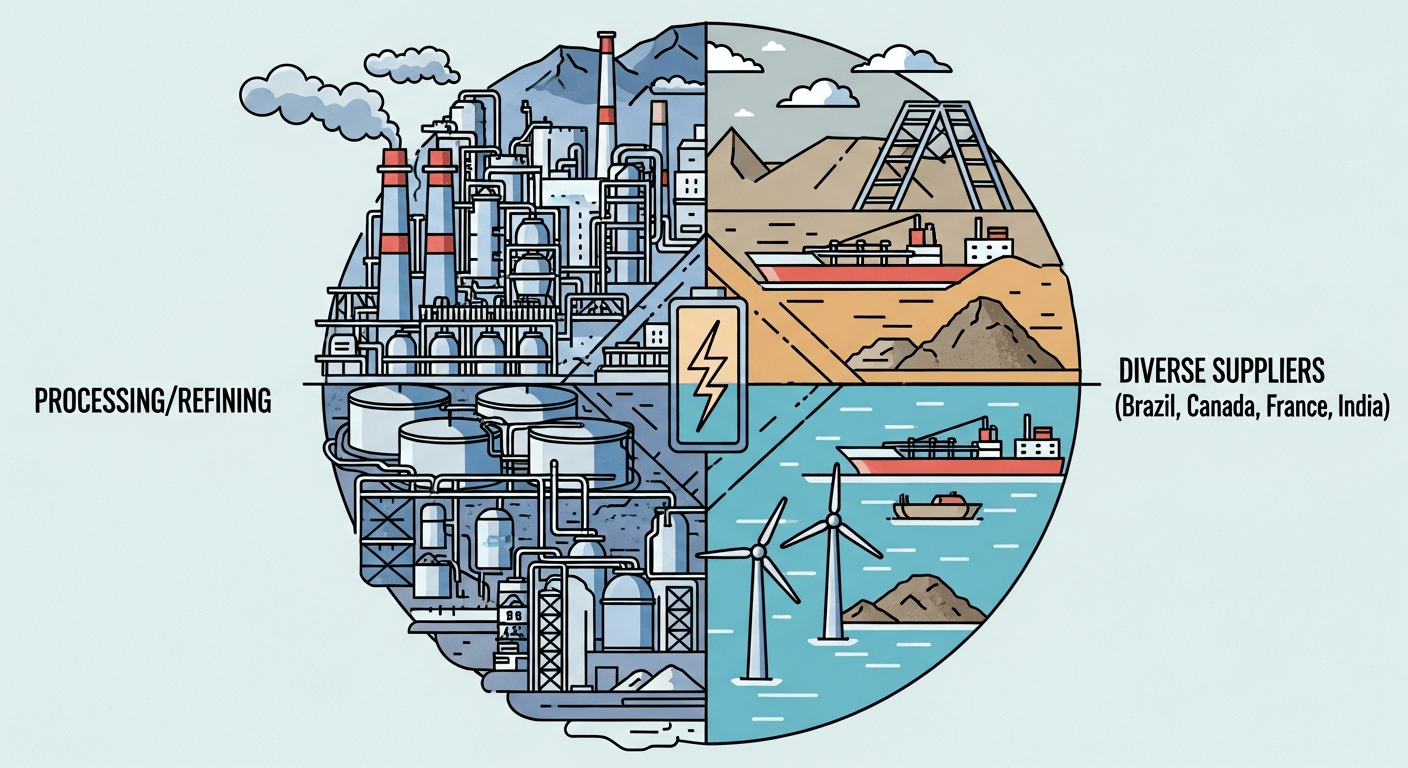

I’ve been watching India’s quiet, methodical push to reduce its dependence on a single supplier for the metals and minerals that will power our electrified future. Recent reporting shows New Delhi is in talks with Brazil, Canada and France (and others) to build partnerships that go beyond raw exports — covering exploration, processing, recycling and technology transfer — with a particular focus on lithium and rare earths (see reporting summarising the talks) (https://www.business-standard.com/economy/news/india-likely-to-pursue-critical-minerals-deals-with-brazil-canada-europe-126021000558_1.html). This matters because the next decade of manufacturing, defence and clean energy depends on how reliably we source and process a handful of key elements.

Why critical minerals matter now

Critical minerals — notably lithium, cobalt, nickel, graphite and rare earth elements — are the building blocks of batteries, electric vehicles (EVs), wind turbines, solar inverters, semiconductors and advanced electronics. Batteries alone dramatically increase demand for lithium, nickel and cobalt; wind turbines and EV motors rely on powerful permanent magnets that use rare earths. The International Energy Agency’s Global Critical Minerals Outlook lays out the scale of the challenge: demand is set to surge and refining/processing remains highly concentrated globally (https://www.iea.org/reports/global-critical-minerals-outlook-2025).

Where China sits in the chain — and why dependence is risky

China today dominates not only mining in some cases but, crucially, downstream processing and refining for many minerals. That concentration gives China leverage over global supply, pricing and standards for intermediate products. The IEA and other analysts show that refining and separation capacity — particularly for rare earths, graphite and certain battery materials — is heavily skewed toward China, creating strategic vulnerability for countries that import processed inputs rather than raw ore (https://www.iea.org/reports/global-critical-minerals-outlook-2025).

This is why India’s outreach is not just about diversifying mines but about getting access to processing tech, offtake lines and financing structures that keep value-added activity outside a single dominant hub.

What the proposed talks and deals look like

Based on public reporting and government programs, the likely elements of cooperation with Brazil, Canada and France include:

- Target minerals: lithium and rare earths are front and centre; nickel, cobalt and graphite are also in scope. (See recent reporting on India’s outreach.) (https://www.business-standard.com/economy/news/india-likely-to-pursue-critical-minerals-deals-with-brazil-canada-europe-126021000558_1.html)

- Joint exploration and asset acquisition: bilateral pacts often include government-backed exploration support and co-financing for upstream projects.

- Processing/refinement cooperation: technology transfer agreements, joint ventures for separation and refining plants, and co-investment in midstream capacity to produce battery-grade materials.

- Logistics and ports: co-developing secure shipping routes, bonded processing hubs and port-handling facilities to reduce transit times and costs.

- Financing and offtake: export-credit support, long-term offtake contracts and sovereign-backed investment funds to de-risk projects for private investors.

Canada’s own critical-minerals strategy and provincial initiatives make it a natural partner for technology, ESG-compliant mining practice and upstream supplies (analysis on Canada-India possibilities) (https://www.asiapacific.ca/publication/background-note-canada-india-critical-minerals-co-operation). India’s National Critical Mineral Mission further shows domestic policy alignment to attract such partnerships (https://www.pib.gov.in/PressNoteDetails.aspx?id=155158&NoteId=155158&ModuleId=3).

Risks, benefits and geopolitical implications

Risks:

- Time lag: exploration to production often takes 5–7 years, and some prospects never become mines.

- Capital and commercial risk: low prices, technical barriers and public opposition can delay projects.

- Geopolitical friction: China may respond with trade or export measures, or intensify investments elsewhere.

Benefits:

- Supply resilience: diversified sources reduce single-country choke points.

- Industrial policy gains: onshore processing supports domestic manufacturing for EVs, renewables and defence.

- Standards and ESG: partnerships with Canada/France can raise environmental and social governance norms.

Geopolitically, stronger ties with like-minded partners can align India with broader Western and South-South diversification efforts while preserving independent policy choices. Western reactions are likely to be supportive where deals enhance supply-chain resilience; Beijing may view such moves as strategic competition and could respond by tightening downstream controls or accelerating its own overseas investments.

Implications for miners, supply chains, prices and ESG

- Miners: long-term offtakes and financing could unlock previously marginal projects, but the sector will face stricter ESG and traceability expectations.

- Supply chains: building regional processing hubs will shorten value chains and raise barriers to single-point disruption.

- Prices: initial investor-friendly financing and expanded supply can damp price spikes, but new regulations or export curbs could create volatility.

- ESG and communities: investing in environmental safeguards, local value capture and transparent community consent will be essential to avoid social pushback and reputational risk.

Recommended policy steps for India and partners

- Diversify supplier base across continents and chemistry routes rather than just mines.

- Create strategic mineral reserves and stable long-term offtake contracts to smooth demand shocks.

- Scale recycling, secondary sourcing and circular-economy incentives (PLI-style support for recycling facilities).

- Fast-track permitting for responsible processing parks with standardised environmental and labour safeguards.

- Offer tax incentives and sovereign co-investment to de-risk technology transfer and joint ventures.

- Fund centres of excellence for refining and separation technologies and prioritise skills transfer to local workforces.

- Mandate traceability standards and third-party ESG audits to attract premium markets.

(India’s National Critical Mineral Mission and recent policy choices already move in this direction.) (https://www.pib.gov.in/PressNoteDetails.aspx?id=155158&NoteId=155158&ModuleId=3)

Outlook: chances of success and timeline (3–7 years)

Real, material diversification — especially in midstream processing — is achievable but not quick. Upstream deals, exploration and early mining can take 3–7 years to yield commercial volumes; building processing capacity and mature offtake networks toward self-reliance is more likely on the 5–7 year horizon. Success will depend on coordinated financing, clear regulatory signals, and credible ESG safeguards. If India and partners combine diplomatic momentum with targeted public finance and industry commitments, a visible and diversified supply chain can emerge in that timeframe.

I’ll be watching whether these conversations move from memorandums to concrete joint ventures and processing plants. If they do, India’s manufacturing and clean-energy ambitions will be on firmer ground.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

I welcome your comments or a share of this post.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment