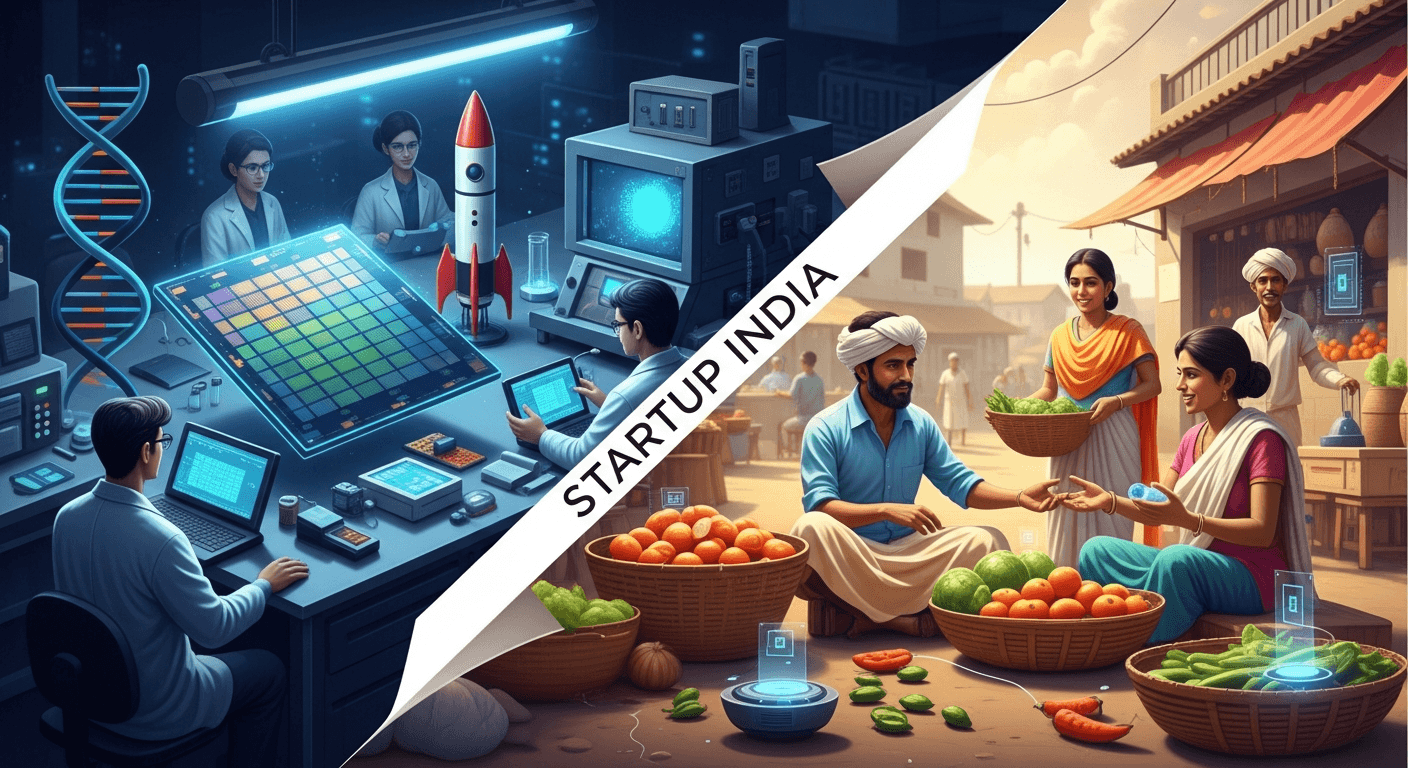

Startup India: Deep Tech & Co-ops

I have been watching India’s startup policy evolve since 2016, and the February 2026 reset of the startup definition is one of those moments that deserves close reading. On the surface it reads like a technical tweak — higher turnover ceilings, a new sub-category, inclusion of cooperatives — but the implications reach into how we fund, regulate and imagine long-horizon innovation in India.

What changed — the essentials

- Turnover threshold for general startup recognition increased from ₹100 crore to ₹200 crore in any financial year.[1]

- A dedicated Deep Tech Startup category has been introduced. These entities can be recognised for up to 20 years from incorporation (vs 10 years for regular startups) and have a higher turnover cap of ₹300 crore.[2][3]

- Cooperative societies (multi-state and state-registered cooperatives) are now eligible for DPIIT startup recognition, opening pathways for community and agriculture-led innovation.[1][3]

- The deep tech category is defined by R&D intensity, ownership or work-in-progress on novel IP, and clear technology readiness/commercialisation plans. The rules also tighten permissible deployment of funds during the recognition period to core business activities.[2][4]

(For the official notification and press summary see the DPIIT/PIB release and contemporary reporting.)[1][2]

Why the government changed the definition

There are three broad drivers behind this change:

- Deep tech realities: Scientific or engineering breakthroughs often require long gestation, expensive infrastructure and patient capital. A 10-year recognition window — fine for apps and marketplaces — often forces premature exits from policy support.

- Commercial scale and R&D reinvestment: Hardware, life sciences and advanced materials startups typically generate revenues earlier or at larger scale while still investing heavily in R&D. Raising turnover ceilings prevents premature “graduation” that strips policy benefits at fragile moments.

- Inclusive innovation: Bringing cooperatives into the fold recognises that grassroots, community-led enterprises (for example in agriculture and rural manufacturing) can be engines of innovation if they get access to procurement, credit and mentoring.[1][3]

Benefits — what this enables

- Patient capital becomes more attractive: A 20-year recognition is a policy signal to long-term investors (pension funds, family offices) that India is serious about deep-tech bets.

- Better alignment of incentives: Higher turnover limits let firms reinvest revenues into R&D without losing recognition prematurely, preserving access to tax and procurement advantages.[2]

- Democratizing access: Cooperatives can now access government benefits, GeM procurement opportunities and mentorship, which could accelerate tech adoption in rural value chains.[1]

- Clearer criteria for deep tech gives founders a predictable path to certification and tax incentives under Section 80-IAC (subject to standard approvals).[2][4]

Challenges and risks to watch

- Verification & gaming: Distinguishing genuine deep-tech R&D from marketing claims will be hard. The certification process must be robust, transparent and nimble to avoid both false positives and bureaucratic delay.

- Fiscal and administrative cost: Expanding benefits increases fiscal exposure (tax incentives, preferential procurement). The government will need to balance generosity with safeguards.

- Uneven implementation: States and local incubators must be prepared to support cooperatives and rural entrepreneurs; otherwise the inclusion could remain symbolic.

- Restrictive fund-usage rules: Limits on investing funds in non-core assets are intended to curb misuse, but rigid application could hamper legitimate diversification or collaborative investments in upstream infrastructure.

Examples (concrete and hypothetical)

Example: A startup building battery materials for grid-scale storage that earns early revenue from pilot commercial sales but still spends the bulk of cashflow on R&D would benefit from the higher turnover cap and extended recognition window.

Example: A multi-state dairy cooperative adopting IoT sensors and a cold-chain process could now pursue DPIIT recognition, access government procurement channels, and qualify for mentorship programs.

[Hypothetical quote] "This extended runway changed our fundraising conversations — investors began valuing our patience as a feature, not a bug," said a founder (hypothetical) of a semiconductor tooling startup that would have otherwise lost recognition at year 11.

[Hypothetical quote] "For a village cooperative experimenting with precision-agri sensors, DPIIT recognition is the difference between a pilot and a scalable programme," said a cooperative leader (hypothetical).

These vignettes are illustrative: they show how policy shifts can alter incentives and investor behavior even without immediate technological breakthroughs.

How to make the reform work better

- Strengthen independent technical review: Use TRL-style frameworks and independent experts to assess deep-tech claims quickly and credibly.

- Build cooperative capacity: Invest in state-level cooperative innovation hubs that help societies meet the documentation, governance and technology criteria.

- Monitor outcomes publicly: Publish anonymised data on approvals, revocations and the sectors receiving benefits to foster accountability.

- Link benefits to measurable R&D milestones: Time-limited, milestone-linked benefits reduce the risk of permanent fiscal leakage while preserving support for genuine long-term projects.

Conclusion and call-to-action

This reset of the startup definition is both pragmatic and strategic. It acknowledges that building foundational technologies — and democratising innovation through cooperatives — requires policy instruments aligned to long horizons and community contexts. But policy alone won’t create champions: implementation, independent assessment and a steady pipeline of patient capital are equally critical.

If you are a founder, investor or cooperative leader, now is the moment to revisit your growth plan and ask: does our story qualify as deep tech? Can we document IP, R&D intensity and a TRL progression? If so, apply for recognition — and use the window to lock in long-term partnerships.

References

- Government of India — DPIIT notification and PIB press release summarising the revised framework. https://www.pib.gov.in/PressReleseDetail.aspx?PRID=2224069®=3&lang=2

- Reporting and analysis summarising the changes and implications (Economic Times / ETGovernment). https://government.economictimes.indiatimes.com/news/economy/india-resets-startup-definition-to-include-deep-tech-companies-cooperative-societies/127975868

- Policy explainer and practical implications (Taxmann / other policy summarises). https://www.taxmann.com/post/blog/dpiit-revises-startup-definition-introduces-deep-tech-framework

- Implementation details and TRL-based assessment discussions (industry write-ups). https://www.storyboard18.com/how-it-works/centre-rewrites-startup-definition-to-recognise-deep-tech-ventures-what-the-change-means-88983.htm

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment