Oil Curbs and Diplomacy

Summary of the incident

I read recent coverage of a sharp public rebuke from Moscow's foreign ministry spokesperson in an interview with TV BRICS, where the Russian side accused the United States of using sanctions and maritime measures to deter third countries from buying Russian crude and petroleum products. The remarks framed the measures as coercive—alleging that Western restrictions, insurance and shipping limits, and tariffs are being used to steer buyers toward costlier alternatives. Reporting on the interview can be found in several outlets, including Moneycontrol and other wire services that carried the transcript and paraphrases of the ministry's remarks Moneycontrol.

Background: the US-led oil curbs and price-cap architecture

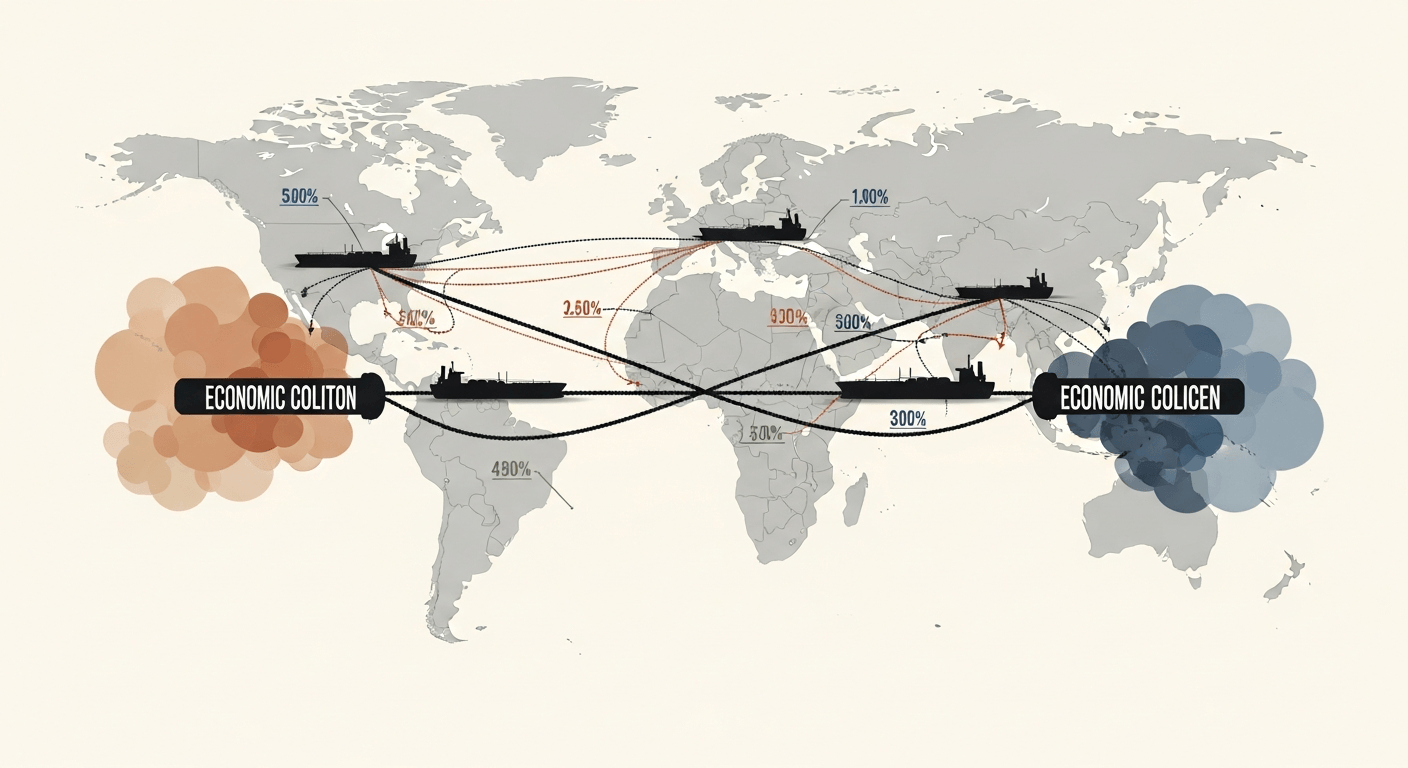

Since late 2022, a coalition of G7 countries, the European Union and several partners introduced a two-part strategy aimed at limiting revenues from a major oil exporter while keeping global supplies flowing. The mechanism combined: (a) an embargo and service bans on certain maritime and financial services for Russian-origin seaborne oil transported above a set price; and (b) a ‘‘price cap’’ that allowed those services to be provided only when cargoes were sold at or below the established threshold. The US Treasury and allied guidance describe the policy as designed to reduce Kremlin export earnings while maintaining market stability and protecting energy security for importers US Treasury fact sheet.

Implementation has relied heavily on the dominance of Western insurers, shipowners and financiers in maritime trade. Where those services are withheld, an exporter must turn to a smaller set of non‑coalition providers or accept the operational and legal risks of a circumvention network.

Geopolitical and energy‑market implications

The dispute is not merely a rhetorical exchange; it reflects deeper shifts in the intersection of economic statecraft and energy security.

Market effects: price caps and sanctions have widened the discount on some Russian crude grades while preserving seaborne flows to non‑coalition buyers. That has helped avoid disruptive price spikes in short order, but it also incentivised workarounds (shadow fleets, opaque ownership structures), complicating enforcement and transparency.

Diplomatic leverage: the measures are a tool of leverage short of full trade embargo. They create incentives for buyers to align procurement with coalition rules if they want secure, insured transport, and conversely they push exporters to cultivate alternative service chains.

Strategic realignment: buyers with large energy needs and limited appetite for sudden supply shocks must weigh commercial savings from discounted cargoes against political and financial costs of being outside the coalition’s service network.

Reactions from India and other affected states

Several reporting outlets note that governments of major importing states have stressed energy security and sourcing decisions guided by national interest. India’s official statements have repeatedly emphasised priorities of availability, affordability and reliability for its domestic market; institutional spokespeople have framed procurement choices as sovereign and commercially driven, rather than dictated by external pressure (see contemporaneous reporting by ANI/NDTV on government statements) [ANI coverage aggregated in reports].

Other importing states—China, some Southeast Asian and African buyers—have taken a pragmatic stance, balancing the diplomatic signalling of purchases with the operational realities of long‑term contracts and refinery configurations.

Legal and diplomatic dimensions

Legally the measures rest on national sanctions authorities, multilateral coordination and domestic implementing rules (export controls, tariff measures, maritime service prohibitions). Enforcement turns on forensic trade documentation, shipping and insurance attestations, and interdictions of entities or vessels involved in circumvention. The invocation of maritime safety and international law—especially when allegations involve interdictions or seizures at sea—adds a layer of diplomatic sensitivity because of potential claims under the law of the sea and commercial maritime regimes.

Diplomatically, the toolbox opens avenues for negotiation and escalation alike: sanctions carve out a space for conditional engagement (compliance in exchange for services), but they also incentivise diplomatic pressure campaigns, technical enforcement cooperation, and legal disputes in international fora.

Possible scenarios and near‑term outlook

Tightening enforcement: coalition partners could deepen intelligence sharing, target specific shadow‑fleet actors, and increase secondary sanctions to shrink circumvention options—putting further downward pressure on exporter revenues.

Partial accommodation: exporters and importers might reach ad hoc commercial solutions—discounts, local currency settlements, or insurance alternatives—that keep flows intact while muting the policy’s fiscal bite.

Fragmentation: if enforcement proves costly or uneven, a bifurcated market could solidify—one channel reliant on coalition services and pricing discipline, another driven by cost‑sensitive buyers and non‑coalition logistics—raising systemic transparency risks.

Diplomatic de‑escalation: parallel diplomatic engagement could attenuate tensions if parties agree carve‑outs for critical humanitarian or developmental supplies, or if political bargains adjust tariff or trade frameworks.

Conclusion

The recent exchange illuminates a central dilemma of contemporary statecraft: using economic instruments to alter behaviour without triggering wider market dislocation or irreversible geopolitical splits. The effectiveness of the curbs will depend less on rhetoric than on enforcement, the resilience of shipping and insurance markets, and the political calculus of major buyers balancing commercial needs against diplomatic alignment.

Regards,

Hemen Parekh

Any questions / doubts / clarifications regarding this blog? Just ask (by typing or talking) my Virtual Avatar on the website embedded below. Then "Share" that to your friend on WhatsApp.

Get correct answer to any question asked by Shri Amitabh Bachchan on Kaun Banega Crorepati, faster than any contestant

Hello Candidates :

- For UPSC – IAS – IPS – IFS etc., exams, you must prepare to answer, essay type questions which test your General Knowledge / Sensitivity of current events

- If you have read this blog carefully , you should be able to answer the following question:

- Need help ? No problem . Following are two AI AGENTS where we have PRE-LOADED this question in their respective Question Boxes . All that you have to do is just click SUBMIT

- www.HemenParekh.ai { a SLM , powered by my own Digital Content of more than 50,000 + documents, written by me over past 60 years of my professional career }

- www.IndiaAGI.ai { a consortium of 3 LLMs which debate and deliver a CONSENSUS answer – and each gives its own answer as well ! }

- It is up to you to decide which answer is more comprehensive / nuanced ( For sheer amazement, click both SUBMIT buttons quickly, one after another ) Then share any answer with yourself / your friends ( using WhatsApp / Email ). Nothing stops you from submitting ( just copy / paste from your resource ), all those questions from last year’s UPSC exam paper as well !

- May be there are other online resources which too provide you answers to UPSC “ General Knowledge “ questions but only I provide you in 26 languages !

No comments:

Post a Comment